Summary: In this article, you will learn how to calculate capital gains tax on real estate investment property. Topics also include, what are capital gains and capital losses, real estate capital gains tax rates, how to avoid capital gains tax on a rental property, and much more.

Introduction

Investing in real estate is one of the best ways to generate income and build real wealth. When an investor sells a long-term rental property at a profit, they’ll enjoy a nice windfall of cash. However, they will also be liable to pay capital gains taxes on the money made from that investment property.

So what happens if tax season rolls around and capital gains taxes take half of your investment return? In reality, this scenario happens to real estate investors all the time. It’s like getting a $10,000 bonus at work and only getting $7,800 after taxes.

long term investing

The good news is, there are ways for real estate investors to offset capital gains and minimize getting hit with a huge tax bill. To start, let’s jump into the basics.

What Are Capital Gains?

Capital gains are the profits made from selling an investment. If an asset is later sold at a higher price, that “increase” would be considered a capital gain.This could be profits from selling stock market investments, real estate assets, a business, land, etc.

For example: A stock you bought 10 years ago for $5,000 is now worth $55,000. When you sell the stock, that $50k is considered a capital gain and will be taxed as such. Basically, capital gains are any investment that produces a monetary return when it’s sold. On the other hand, investors may experience capital losses with their investments, which we’ll explain next.

What is a Capital Loss?

A capital loss is when an investment is sold for less than its original purchase price. Capital losses are significant when it comes time to file taxes because they can be subtracted from capital gains. Investors will use capital loss strategies to offset their capital gains taxes.

What Are Capital Gains Taxes on Real Estate Investments?

Capital gains from real estate investments are taxed when the asset is sold. Regardless of how much the property realizes or grows over time, investors won’t have to worry about capital gains until they sell.

These taxes can be imposed on both a state and federal level. Keep in mind that taxes on capital gains only apply to investment properties–not primary residences–as long as the homeowner lives in the home for two years or more.

Real Estate Capital Gains Tax Rates

Most states tax capital gains at the same rate as your federal income tax. Some states are super tax-friendly and have no income tax and no capital gains taxes. Other states have no income tax, but still tax dividends and interest. Where your rental property is located will play a major factor in how much you’ll be taxed for capital gains at a state level.

How long you own a rental property and your taxable income will determine your capital gains tax rate. Short-term investments held for one year or less are taxed at your ordinary income tax rate. Tax rates for short-term gains in 2020 are: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

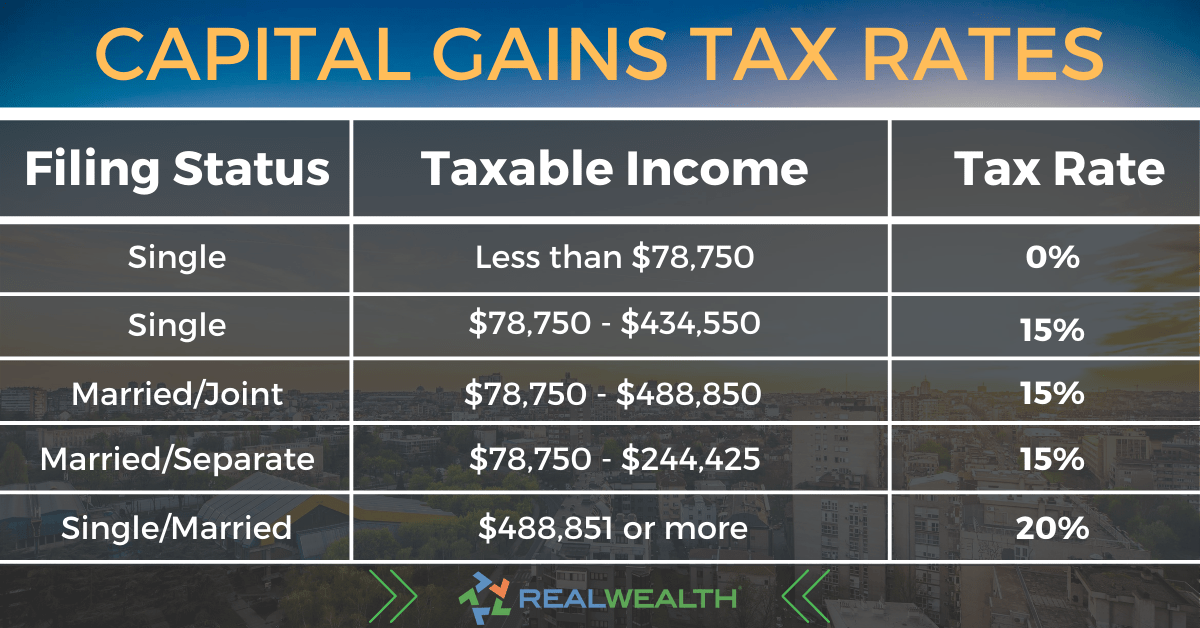

Investments held long-term, more than one year, will be taxed at a lower rate. The following are tax rates for capital gains on long-term real estate investments sold in 2022:

How to Calculate Capital Gains Taxes on Real Estate

In order to accurately calculate capital gains taxes on real estate, first subtract the “cost basis” or original purchase price of the house from the “net proceeds” or net profits of the sale.

Cost basis includes expenses (i.e. closing costs, fees, etc.,) at the time of purchase and any major improvements made to the property, (a new roof, windows, or electrical system, etc.) Routine maintenance and superficial repairs/updates (new paint, light fixtures, etc.) don’t count towards your cost basis deduction.

Net Proceeds is the money you, the investor, walks away with after all the closing costs are said and done. Any costs accrued during the sale of a property can be deducted from the gross profits.

For example: Elaine bought an investment property in 2000 for $250,000. In 2020, the property sold for $550,000. Her total capital gain is $300,000, before subtracting expenses and improvement costs. Now let’s assume the following associated expenses:

- $10,000 in closing costs upon purchase of the rental property,

- $10,000 for a roof replacement,

- $25,000 for new plumbing, and

- $50,000 in commissions and fees upon sale of the rental property.

In this scenario, Elaine’s cost basis would be $295,000 ($250,000+$10,000+$10,000+$25,000). Her net proceeds would be $500,000 ($550,000 – $50,000).

Now, deduct Elaine’s cost basis from her net proceeds to determine the total capital gains on the investment property.

(Net Proceeds) – (Cost Basis) = (Total Capital Gain)

$500,000 (Net Proceeds) – $295,000 (Cost Basis) = $205,000 (Total Capital Gain)

The investor will then be responsible for paying a percentage of the total capital gain, depending on their tax rate. Next, we’ll use an example to illustrate how to calculate capital gains taxes when you sell a rental property.

How Much Tax Do you Pay When You Sell a Rental Property?

Everytime an investor sells a rental property, they should know how much to expect to pay in taxes. Using the example above, let’s calculate the capital gains taxes on Elaine’s investment property.

Elaine is a single-filing taxpayer with an annual income of $100,000. Because she earns more than $78,750 per year, Elaine will be taxed on 15 percent of her total capital gain.

- $205,000 x 15% = $30,750 Capital Gains Taxes

- Total Return on Investment: $174,250

It’s easy to see the impact capital gains taxes can have on your ROI. Fortunately, there are several ways to avoid these high taxes when selling your investments.

HOW TO AVOID CAPITAL GAINS TAX ON RENTAL PROPERTY?

There are a number of ways for all types of investors to lower their capital gains tax burden. It could be through selling investments at a loss, utilizing a 1031 exchange to “swap” rental properties or converting a rental into your primary residence. Each of these strategies are commonly used to provide tax relief for investors and offset capital gains.

Tax-Loss Harvesting

Tax-loss harvesting is when an investor sells underperforming investments at a loss, in order to minimize capital gains taxes. This strategy works best if you’re looking to offload bad investments and turn them into tax deductions.

Picture this: Last year you sold an investment property and made a net profit of $100,000. In the same year, you sold some bad stocks at a $75,000 loss. Because you are allowed to subtract capital losses from capital gains, your tax liability would now be $25,000. This is a common strategy used by investors to avoid paying big capital gains taxes. After selling investments at a loss, some investors may choose to reinvest that money.

Section 1031 Exchange

The IRS has outlined under section 1031 a “like-kind” exchange of investment properties. This strategy doesn’t reduce capital gains taxes, just defers some or all of these taxes to a later date. Using a 1031 Exchange, investors may sell a rental property and “swap” it for a similar or “like-kind” property.

This is a great strategy for investors looking to get out of poorly performing real estate markets and into strong, growing markets.

Max Out Your IRA/401k

Investors that are worried about getting crushed by taxes should consider ways to decrease their taxable income. One of the most common ways to do that is by contributing to your retirement accounts. Maxing out an IRA or 401k allows investors to keep their money safe reduce how much of their income can be taxed.

Convert Rental Into Primary Residence

There are way more tax benefits when you sell a primary residence as opposed to an investment property. That’s why some investors will choose to convert a rental property into their primary residence. While this may not be an option for everyone, it can provide huge tax benefits.

In order to qualify for primary residence tax exemptions, investors must own the property for at least five years, and have lived in it for at least two of those years. When selling a primary residence, single investors may exclude as much as $250,000 of profits. And those that are married filing jointly can exclude up to $500,000 of profits. Turning a rental property into your primary residence can qualify you for big tax savings and help avoid capital gains taxes.

Sell When Your Income is Low

Another great strategy to reduce the impact of capital gains on your investment property is to time when you sell. If you know you’re heading into some “thin” years or your spouse is planning on quitting their job, that would be a great time to consider selling. Your income will be less, which may put you in a lower tax bracket and lower your capital gains tax responsibility.

Donate to Charity / Gift It

Donating an asset to charity not only saves you from capital gains taxes, it also comes with a tax deduction. The IRS allows investors to deduct the assets’ fair market value and the charity doesn’t have to pay capital gains taxes either (because they are tax-exempt).

Investors can also choose to gift an appreciating asset to family members. This works well if the family member receiving the gift is in a lower tax bracket, because if they decide to sell, they’ll be taxed at a lower rate. Parents looking to reduce capital gains taxes might consider giving away some real estate assets to their kids now rather than later. Keep in mind that this strategy doesn’t work for dependents under of the age of 24, (as they have no taxable income).

Wait 'Til You're Dead

This may sound strange, but keeping your assets until you’re gone is pretty common estate planning strategy to avoid paying taxes on capital gains. Assuming the asset has appreciated over time, the beneficiaries can take advantage of a “step-up” in cost basis. This “step-up” is to help offset capital gains taxes on inherited assets.

CONCLUSION

Learning how to calculate capital gains tax on real estate investment property isn’t as difficult as it sounds. With a basic understanding of how taxes work in real estate, investors can take advantage of money-saving tax strategies to reduce their tax burden and increase overall return.

Experienced real estate investors should always have a plan in place to avoid, or at least minimize capital gains taxes. One of the best ways to make sure capital gains don’t cut into your profits is to find the right financial advisor or tax professional. These experts should work with you to map out a plan to help you hit your investing milestones, build real wealth and reach your retirement goals.