Summary: In this comprehensive guide, we’ve gathered over 25 expert housing market predictions for the next 5 years (2024 through 2028), offering invaluable insights from industry leaders and authoritative sources. Whether you’re a seasoned investor, a first-time homebuyer, or simply keeping an eye on the real estate market, these predictions will arm you with the knowledge to make informed decisions and stay ahead of the curve.

Introduction

The U.S. housing market has been on a roller coaster ride for the last couple years, and experts are predicting that things are going to get worse before they get better.

Mortgage rates, housing shortages, and high prices have made for a tough housing market for Americans looking to purchase a new home. So what does the future hold?

In this article, we’ll look at 25 future housing market predictions and trends using data and information from housing market experts and authoritative sources like CoreLogic, the NAR, NAHB, and more.

As we look ahead, these expert housing market predictions for the next 5 years serve as a vital compass. After reading this article, you’ll be better informed about how to navigate the housing market as an investor, mortgage professional, builder, home buyer or seller.

long term investing

Key National Housing Market Trends & Predictions for 2024 and 2025

Below, we explore the housing market trends and predictions for 2024 and 2025 in the following sections: home prices, mortgage rates, demand and supply, moving and home construction trends.

Home Price Trends & Predictions

1. Month-over-month declines in home prices; moderate year-over-year appreciation.

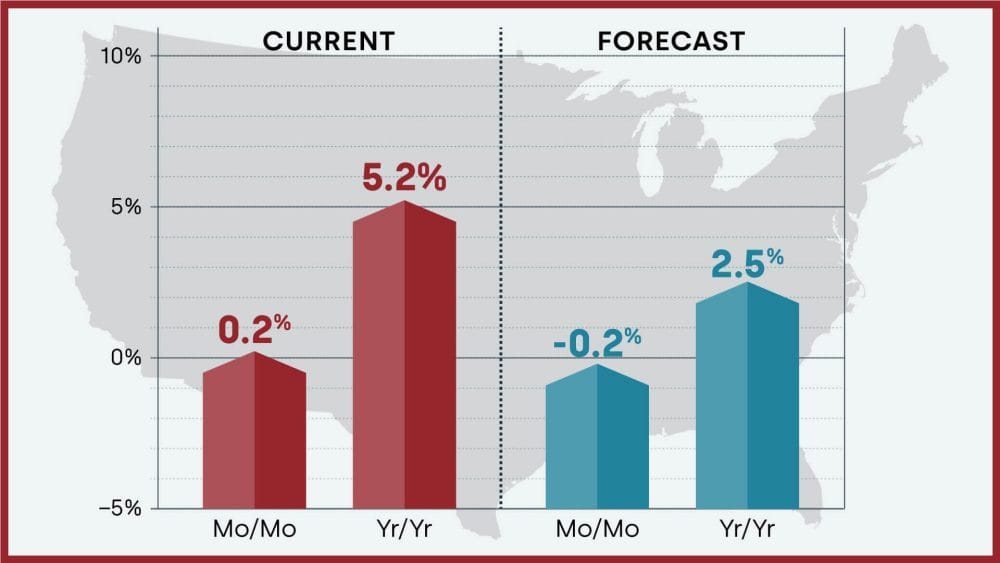

The US housing market witnessed explosive price growth in 2022, but experts predict a shift towards stabilization and moderate appreciation in 2024 and 2025. According to the CoreLogic HPI Forecast, home prices were expected to decrease slightly (-0.2%) month-over-month from November to December 2023 and increase year-over-year by 2.5% from November 2023 to November 2024.

Source: CoreLogic

Dr. Selma Hepp, CoreLogic’s chief economist, shares her insights on the topic:

“Home price appreciation continued to push forward in November, despite the new highs in mortgage rates seen over the year. And while the annual growth reflects comparison with last year’s declines, seasonal gains remain in line with historical averages. However, in some metro areas, such as those in the Mountain West and the Northwest, higher interest rates are having a greater impact on homebuyers’ budgets, which is contributing to a larger seasonal slump. This continued strength remains remarkable amid the nation’s affordability crunch but speaks to the pent-up demand that is driving home prices higher.”

Realtor.com’s forecast points to a 1.7% decrease in year-over-year median home prices in the US. Consequently, the home purchase mortgage payment share compared to median income (a measure of affordability) is anticipated to decline to an average of 34.9% in 2024, with this share falling below 30% by year-end.

While the moderated pace of price growth and easing mortgage rates could provide buying opportunities for some, particularly if housing inventory increases, affordability challenges are likely to persist for many first-time buyers.

2. South and Northeast cities lead in projected home value increases.

In the coming years, regional disparities will define the US housing market, with growth rates expected to diverge significantly across various areas. Some regions will continue experiencing price increases, while others might witness price declines.

Housing market dynamics are influenced by a variety of factors including:

- Job Market: A robust job market directly correlates with higher housing demand, translating to price increases in economically thriving areas.

- Affordability: High interest rates making mortgages more expensive, alongside high housing costs, can put significant pressure on affordability, slowing down the real estate market.

- Inventory: A crucial determinant, limited supply usually leads to price hikes whereas excessive inventory can cause prices to either stagnate or decrease.

According to SmartAsset’s analysis using September data from Zillow, the Southern region of the United States is projected to witness substantial home price growth. Approximately 80% of the top 50 zip codes forecasted for the highest increase in home prices belong to the South. For instance:

- Winston-Salem, NC (8.7% in 27105; 7.3% in 27107)

- Athens, GA (7.9% in 30605; 7.7% in 30606)

- Myrtle Beach, SC (7.8%)

- Savannah, GA (7.8%), and

- Charlotte, NC (7.5%)

CoreLogic’s report emphasizes the sustained appreciation in Northeastern states, with Rhode Island, Connecticut, and New Jersey witnessing double-digit growth. Moreover, 24 states have outpaced the national home price gains, with the strongest surges seen in the Northeast, South, and Midwest regions. The relative affordability of these areas is largely responsible for this consistent appreciation.

The report gives an insight into the emerging trend: “Many of the nation’s current fastest-appreciating real estate markets lagged in price growth during the pandemic but have recently benefited from job gains, driven by The Inflation Reduction Act and the CHIPs Act, spurring housing demand.”

Looking ahead, the US housing market’s direction in 2024 and 2025 will likely be steered by the interplay between the job market, housing affordability, and inventory levels.

3. Possibility of a mild US recession.

Rising interest rates, combined with high consumer spending, have led some experts to believe there will be a recessionary period in 2024.

The US housing market is currently experiencing a mix of factors that contribute to recession fears, with rising interest rates and high consumer spending being key indicators. While some economists predict a mild recession by mid-2024 or early 2025, others believe the economy will navigate through slower growth without a recession.

In its September 2023 commentary, the Fannie Mae (FNMA/OTCQB) Economic and Strategic Research (ESR) Group speculates a modest downturn as consumption continues to outweigh incomes, and ripples of previous monetary policy tightening course through the system.

Rick Sharga, Founder & CEO of CJ Patrick Company, adds substantial context to this forecasting debate. In a recent webinar with Kathy Fettke, my beautiful wife and Co-founder of RealWealth, he explains that per his historical data analysis, “…If you look at each time since World War II when the Federal Reserve raised the FED funds rate to control inflation, 11 instances occurred not counting the current cycle. Eight of these led to a recession, while only three times they executed a ‘Soft Landing.’”

Sharga adds that an overcorrection could still thrust the economy into recession. He voices concerns about the Fed’s delay in managing inflation, however, he expresses reserved optimism about another ‘Soft Landing’.

Despite recessionary fears, the US economy is currently healthy, with a GDP growth rate of 5.2% in the third quarter of 2023 and 3.3% in the fourth quarter. Unemployment numbers are also continuing to come in near historically low levels, which is a positive sign for the economy. Amidst lurking recession fears, Sharga emphasizes, “these positive factors suggest that if a recession does occur, it’s likely to be very short and mild.”

But as we gear up for 2024 and 2025, the general consensus seems to lean towards a potential slowdown. Whether this transforms into a full-blown recession or remains a slight dip in growth trajectory, is yet to be seen. However, the health of the economy so far suggests we may weather the storm without severe consequences in the US housing market. Regardless of the direction the wind blows, potential investors and homeowners should keep an eye on market trends.

4. Slow home sales despite mortgage rates decreasing.

Despite a slight dip in mortgage rates from their 2023 peaks, affordability continues to pose a significant obstacle for many potential buyers.

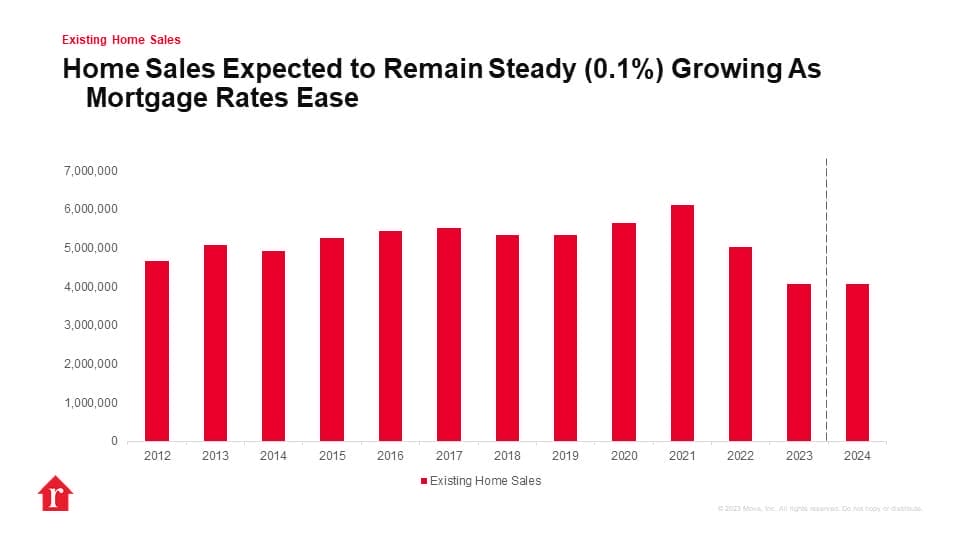

Existing home sales registered a small increase in November 2023 while still reflecting a year-over-year decrease of 7.3%. Data from Realtor.com show that 2023 saw a shade over four million home sales, a decline of 19% over 2022’s five million sales. Heading into 2024, Realtors’ future housing market predictions suggest subdued real estate sales, with home sales anticipated to stay around the four million mark.

Source: Realtor.com

While mortgage rates are projected to ease throughout the year, the persisting high costs could force many existing homeowners to stay put.

Fannie Mae, in its own predictions, anticipates successive quarterly sales increases in 2024. In their January 2024 economic projections, around 4.5 million homes are expected to be sold by the end of the year.

Rick Sharga, connects this trend to what he terms “rate lock” or a “lock-in effect.” He says that “[about] 70% of people with an active mortgage have an interest rate of 4% or lower. If you’re sitting on a 3% mortgage and buy a new home today for exactly the same amount of money you sold yours for, you’d end up doubling your monthly mortgage payments, and most people simply can’t afford that.”

Rick asserts that if mortgage rates can fall to, or below, 5.5%, people would begin rationalizing selling their property and buying a new one. He explains:

“Without this, we may see another year or two, maybe even three, of lackluster home sales numbers, as the market gradually transitions from a low-interest-rate core to a current interest rate core.”

Mortgage Rate Trends & Predictions

So what’s going to happen with mortgages? Here are four important mortgage rate trends and USA housing market predictions for the next 5 years, supported by expert opinions and data:

1. Year-over-year increase in mortgage applications.

The US housing market is currently experiencing a surge in mortgage applications, with the Mortgage Bankers Association (MBA) reporting a 10.4% increase in mortgage applications for the week ending January 12th, the most in a one-year period. This jump in applications is largely attributed to lower mortgage rates, which have made homeownership more accessible to potential buyers.

According to the MBA, applications for a mortgage to purchase a new home rose by 9% from the previous week. Meanwhile, applications to refinance a home loan jumped by 11%, sustaining a fast pace of growth from the 19% surge in the first week of the year. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) in the US also fell by 6bps to 6.75%.

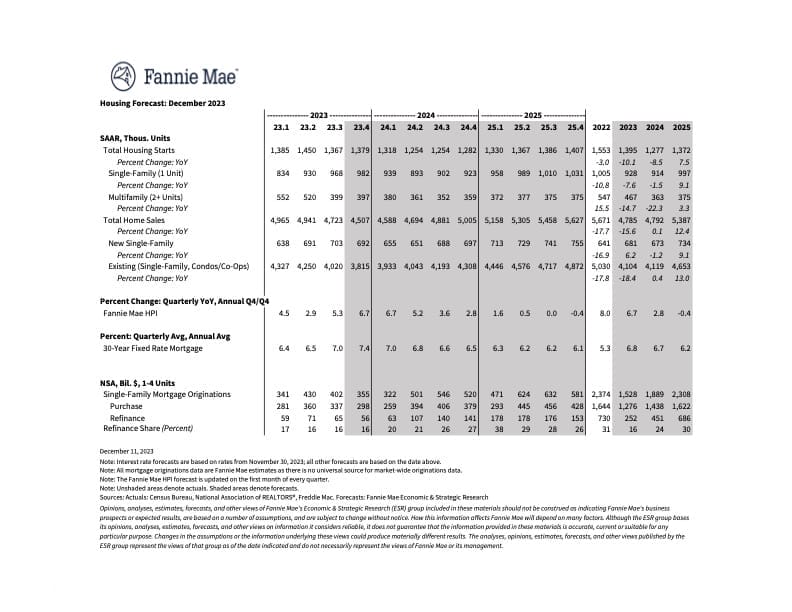

Fannie Mae forecasts that total single-family mortgage originations will reach approximately $1.98 trillion in 2024 and $2.44 trillion in 2025, an increase from the $1.5 trillion in 2023. The organization expects 2024 single-family purchase origination volumes to be $1.5 trillion, a 19 percent increase from $1.3 trillion in 2023.

However, it’s predicted that single-family refinance mortgage originations will stay modest as the 30-year fixed mortgage rate, foreseen to settle just below 6%, remains high relative to most current mortgages.

Joel Kan, Vice President and Deputy Chief Economist of the MBA, noted that new home sales continue to be stronger than existing-home sales, as buyers increasingly turn to newly constructed homes given the dearth of existing home listings and how competitive the bidding process still is.

2. Consistent dips in mortgage rates.

Recent trends and expert predictions point to a progressive easing of mortgage rates, instilling renewed confidence in potential homeowners, builders and investors.

Fannie Mae suggests a gradual easing in the 30-year fixed rate mortgage rate across 2024, anticipated to fall below 6% towards the year’s end. This prediction follows the Federal Reserve’s December meeting, broadly interpreted as signaling a more neutral stance on monetary policy.

The 30-year mortgage rate, currently sitting at 6.91%, mirrors this downward trend, having dropped from its October peak of 7.79% as per the latest Freddie Mac survey.

Further projections from Fannie Mae’s December revised housing market forecast underscore this trend. The 30-year Fixed-Rate Mortgage (FRM30) is forecasted to continue its descent, averaging 6.7% in 2024 and 6.2% in 2025, a noticeable reduction from the 7.4% rate in Q4 2023. However, the predictions caution about the potential for rate volatility tied to monetary policy shifts.

Source: Fannie Mae

Despite the anticipated easing in mortgage rates, the annual average rates are predicted to stay above 6.5%.

Consequently, the so-called “lock-in effect” — the gap between the market mortgage rates and the rates homeowners enjoy on their outstanding mortgages — is expected to persist. About two-thirds of all outstanding mortgages have a rate under 4%, with over 90% possessing a rate below 6%.

Rick Sharga views the decline in mortgage rates as a gradual process. “I believe the most likely scenario is that mortgage rates do come down over the course of 2024, but they come down slowly and gradually. And don’t be surprised if over the course of the next 12 months we see them tick up a little bit before they tick back down”.

I completely agree with this! The FED stimulated the economy by buying a lot of Mortgage Backed Securities and now they’re selling them. So that in itself is a reason why mortgage rates won’t go down that much right now because they’ve got to offload many of the Mortgage Backed Securities they bought.

3. Affordability issues persist.

Our 5 year housing market forecast indicates that housing affordability will remain a poignant issue in the US housing market, even with consistent attempts to lower mortgage rates. A combination of heightened home prices in several markets and the escalating costs of living have dauntingly placed homeownership beyond the financial capabilities of many first-time buyers. This is particularly distressing given that first-time buyers historically comprise 30%-40% of all American home sales.

According to Realtor.com’s 2024 housing market predictions, we can expect a slight decrease in typical housing purchase costs by 2024, accounting for nearly 35% of income, or just below $2,200. Although this figure is still notably higher than historical averages, it represents an important first step towards improved affordability.

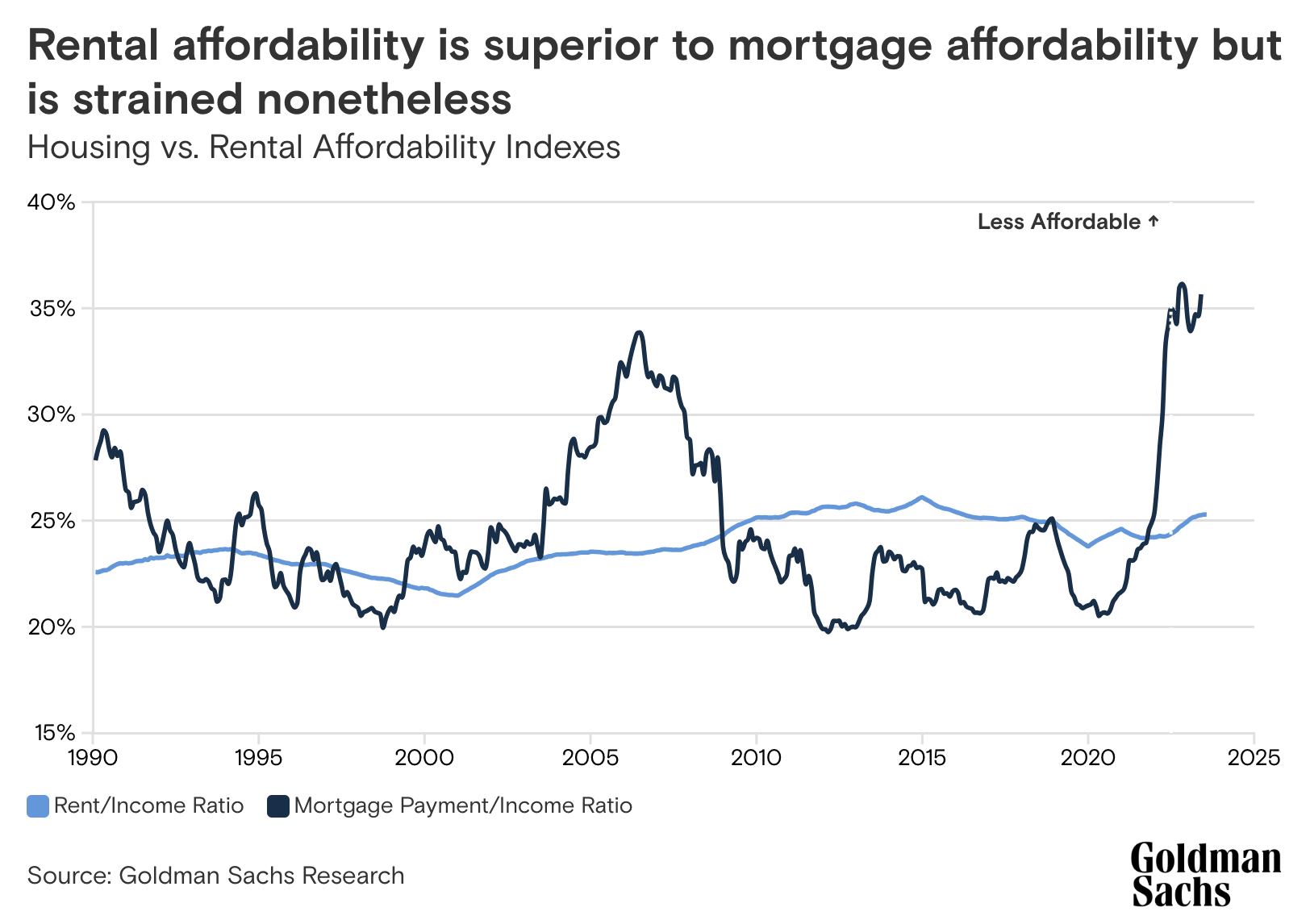

By 2025, Goldman Sachs expects a 3.7% rise in prices, propelled in part by existing momentum in housing prices. The banking giant also anticipates that thirty-year fixed mortgage rates will fall to 6.3%, which would make homes slightly more affordable. However, affordability remains a central challenge, predominantly in the all-important first-time buyers’ market.

Goldman Sachs’ managing director and research analyst, Roger Ashworth, stresses this point:

“The largest demographic in the US is 30- to 39-year-olds, and it’s going to continue to grow for the next several years. That’s when life events start to happen in terms of having kids, for example. Some of those people will be making the decision to buy regardless of how rental affordability compares, but it definitely still factors in. With financing costs that much higher right now, it’s still cheaper to rent than to buy. And we believe mortgage affordability will only slightly improve in the near term under our baseline housing and mortgage forecasts.”

Source: Goldman Sachs

Finally, it is worth noting that JP Morgan predicts that affordability may revert to average levels within the next 3.5 years but some markets might need more time to adjust than others.

4. Inflation expected to slow down, but still a threat.

Inflation in the United States—although decelerating from the peaks of 2022—remains notably above the Federal Reserve’s target of 2%. The Consumer Price Index (CPI) for December 2023 noted a monthly surge of 0.3%, with an annual increase of 3.4%. The Core CPI, which excludes volatile elements like food and energy prices, followed a similar trend with a monthly increment of 0.3% and a 3.9% annual jump.

According to Seema Shah, Chief Global Strategist at Principal Asset Management, these are not unsatisfactory figures, but they undoubtedly indicate a sluggish and perhaps non-linear path to the desired 2% disinflation. Shah asserts, “Certainly, as long as shelter inflation remains stubbornly elevated, the Fed will keep pushing back at the idea of imminent rate cuts.”

On a brighter note, should inflation decline enough, we could potentially see a significant sentiment shift in the housing market—a sector customarily reactive to interest rate changes. Anticipated rate cuts from the Federal Reserve could catalyze sub-6% mortgage rates, triggering a revitalization of the housing supply and acting as a windfall for prospective buyers.

Housing market projections from economists at the University of Michigan forecast that Core CPI inflation will be around 4.0% year over year in 2024 Q4, slowing down to 3.0% in 2025 Q2, 2.8% in 2025 Q4, and finally, 2.5% in 2025 Q4. If their predictions hold true, we will see an echo of historical inflation patterns and a more stable economic environment in the next couple of years.

Housing Inventory and Demand Trends & Predictions

1. Housing starts remain weak in 2024 and rebound in 2025.

2023 saw an intriguing twist in the US housing market, with new-home sales on the rise despite soaring mortgage rates. Builders resorted to various incentives to keep the wheels turning—from buying down interest rates to enticing buyer’s agents with co-op commissions. Yet, overall housing starts numbers are expected to remain weak due to factors such as high mortgage rates, regulations, and supply chain disruptions.

In 2023, housing starts experienced a noticeable contraction, with a 10.3% annual decrease. However, 2024 housing market predictions from Realtor suggest modest improvements, anticipating a 0.4% YoY uptick at 0.9 million SFR housing starts.

Fannie Mae, on the other hand has a more optimistic outlook, projecting a healthy 5.7% increase in single-family housing starts against 2023 figures.

Alicia Huey, the chairperson of the National Association of Home Builders said: “Lower interest rates and a lack of resale inventory helped new-home construction in November. And while these higher starts are consistent with our latest builder survey, which shows a rise in builder sentiment and future sales expectations, home builders continue to contend with elevated construction and regulatory costs.”

Fannie Mae offers a counterbalance to the single-family optimism, anticipating that multifamily housing starts will decline by 18.3% in 2024. This is corroborated by the trends reported by the University of Michigan’s Department of Economics. Despite single-family housing starts showcasing some resilience—peaking at 961,000 units in 2023Q3—a slight deceleration is expected towards 2024-2025, with starts eventually reaching a pace of 988,000 units by 2025Q4.

Contrastingly, the report indicates that after peaking in 2022, multifamily starts have dropped from 552,000 units in 2023Q1 to 398,000 in 2023Q3, signaling a shift as the market grapples with an influx of completed units and climbing vacancy rates. The projection suggests a slow recovery, with a gradual climb to 429,000 units by 2025Q4.

2. Rental supply to outpace demand with a mild decline in median annual rents.

In our real estate forecast for the next five years, we take account of the shift occurring in the US rental market. After record-breaking rent increases in 2021 and 2022, the US rental market is stabilizing. According to a report on rental housing from Harvard University’s Joint Center for Housing Studies, rent growth peaked at 15% in early 2022, but by the third quarter of 2023, it had dropped to 0.4%. This sudden change was consequent to more housing units coming into the market, pushing the apartment vacancy rate to 6.6%, a significant increase from 5.6% in early 2021.

Realtor.com predicts that the rental market dynamics of 2023 will persist into 2024 and 2025. This projection asserts that the tug of war between supply and demand will result in a slight annual decline of 0.2% in median asking rents.

According to experts at Realtor, “the strong construction pipeline–which hit a record high for units under construction in the summer of 2023–is expected to continue fueling rental supply growth in 2024, pushing rental vacancy back toward its long-run average.”

Nationwide rent growth plummeted to 0.8% in the third quarter of 2023, well below the inflation level. However, it’s worth noting that rent growth still surpassed inflation in specific markets, such as Odessa and Midland in Texas, Decatur and Rockford in Illinois, and Goldsboro in North Carolina.

Meanwhile, the median asking rent in November 2023 dipped to $1,717, down by $12 month-to-month and $59 year-over-year, but was still $313 (22.3%) higher than the same time in 2019, pre-pandemic.

Note that most of these rental data is for multifamily, not single family rentals. While double digit growth has stopped across the board, SFR rental properties in hot markets are still seeing 5%+ year-on-year rent growth.

3. Competition for homes persists, spurred by low inventory.

Despite the uncertain economic landscape, housing demand persists in regions with strong job growth and affordable living. Realtor.com’s data from December 2023 shows that there were 714,176 active housing listings—an incremental rise of 4.9% compared to the previous year, though still a stark contrast to inventory levels before the pandemic.

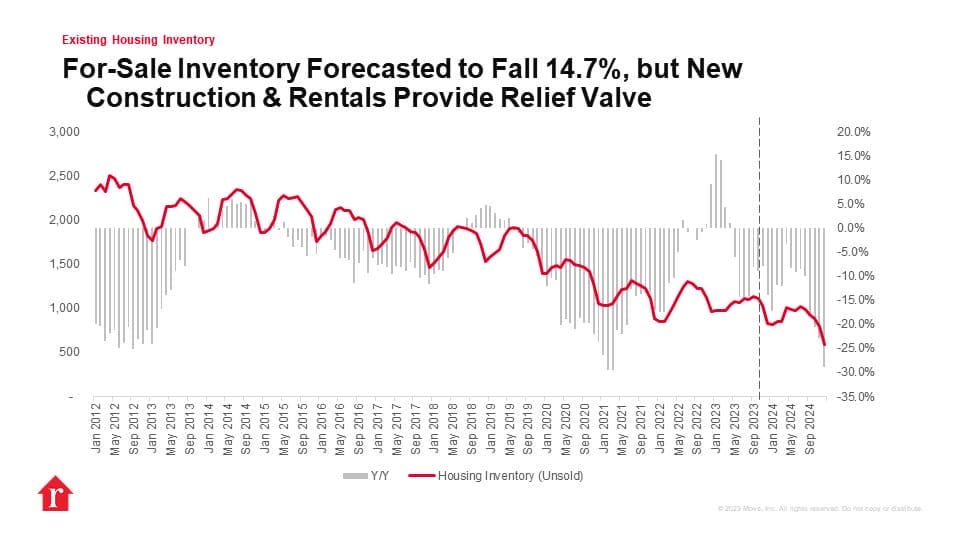

In 2024, inventory levels are projected to remain strained. Realtor.com anticipates an overall year-over-year dip of 14.7% in for-sale inventory.

Source: Realtor.com

A sector of the population poised to significantly influence the market are Millennials, many of whom are entering the home-buying phase as first-time purchasers. Their demand, in the face of such limited housing stock, is predicted to nudge home sales moderately upward. Paired with the existing scarcity, this demand is likely to contribute to a projected home price uptick of 2.8% in 2024 and 2.0% in 2025, according to forecasts by Freddie Mac.

According to the Freddie Mac report, the Housing Market Index, which had been on a downward trajectory since August, saw a marked improvement in December 2023. November showed an uptick in existing home sales, although pending home sales in the same month experienced a notable 5.2% contraction from the year prior.

The FHFA Purchase-Only Home Price Index highlighted a 6.1% year-to-date increase in home prices up until October 2023, underscoring the pressure on home prices as more buyers are anticipated to compete over the scant number of available homes.

As the market moves forward, the delicate balance between affordability and availability will remain a central theme for the U.S. housing market, with broad-ranging implications for buyers, the construction industry, and policy makers alike.

4. Inventory levels will vary across the country as builders skew towards the South.

The distribution of new construction is markedly uneven across the United States. Builders are increasingly concentrating on the Sun Belt states of the South, lured by factors such as favorable zoning regulations, a mild climate, and a ballooning population. Contrastingly, construction in northern regions remains relatively slow, leading to a widening inventory deficit.

RE/Max‘s December 2023 National Housing Market report showed new listings experienced the most significant year-over-year decrease in Manchester, NH (-31.3%), Anchorage, AK (-18.1%), and Indianapolis, IN (-13.7%). Conversely, the markets with the largest year-over-year increase in new listings percentage were Bozeman, MT (+75.6%), Houston, TX (+22.0%), and Phoenix, AZ (+19.6%); this surge was observed primarily in South and Western states.

One catalyst for the South’s inventory growth is the ongoing population influx. The 2023 U-Haul Growth Index, derived from mover volumes using one-way rentals, identified Texas and Florida—for the third consecutive year—as the top two growth states, followed by North Carolina, South Carolina, and Tennessee.

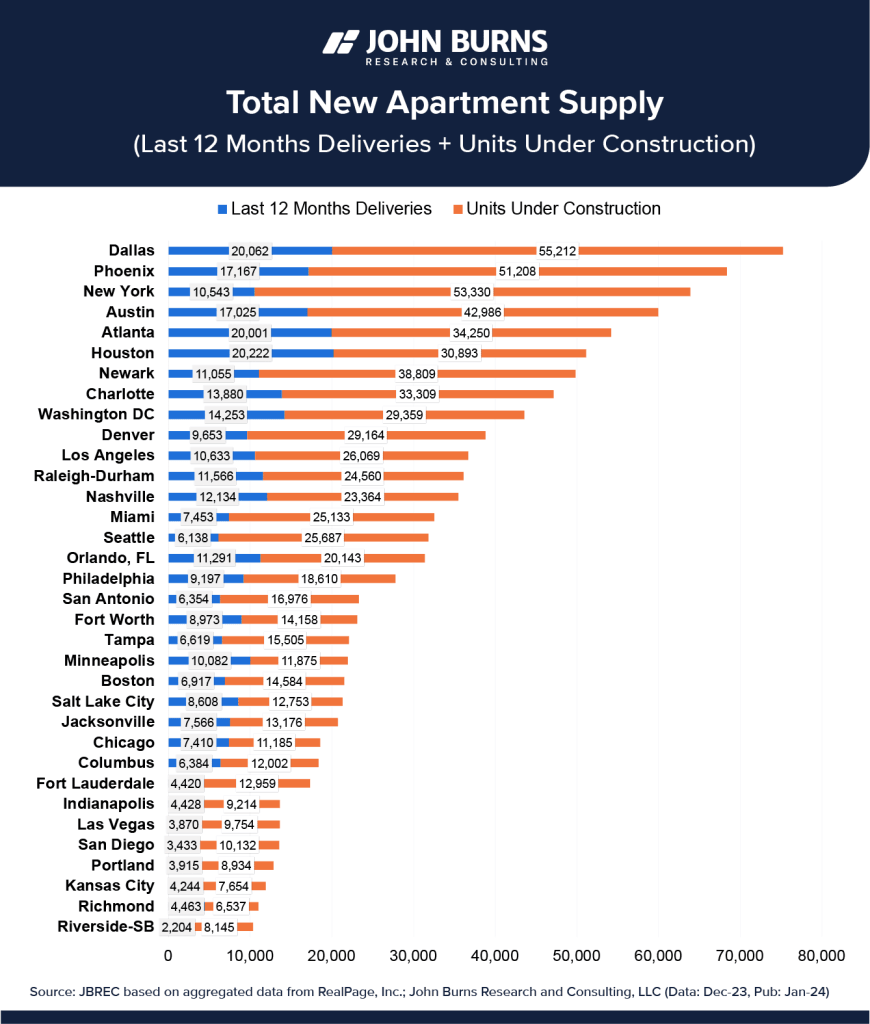

According to John Burns Consulting, approximately 1 million apartment units were under construction at the beginning of 2024, approaching an all-time high for the US. Of these, around 670,000 units are slated for delivery within the year.

The Dallas metro area is at the forefront of apartment construction nationwide. In 2023, over 20,100 units were inaugurated, with an additional 55,200 under construction as of the start of 2024, resulting in a total of approximately 75,000 new apartments. The majority of new construction is situated in northeastern suburbs like Allen, McKinney, Frisco, and Denton.

Source: John Burns Consulting

Phoenix, too, is witnessing an unprecedented apartment boom: 17,100 units delivered in the past year and roughly 51,000 in progress, summing up to over 67,000 units. Rounding out the top five metros for total new apartment supply are New York, Austin, and Atlanta.

Rick Sharga presents a summary of these location trends and how important they are for investors:

“While on average, prices are up year-over-year, there are markets where we’re still looking at price declines. Salt Lake City, Las Vegas, Phoenix, Coastal California, the Pacific Northwest, Austin, New York, parts of New Jersey, and Chicago are still seeing prices decline on a year-over-year basis, so it really depends on where you’re investing.”

Sharga identifies affordability as the primary driver of robust demand in certain markets: “Across the South, Southeast, and parts of the Midwest, we’re seeing much stronger price growth than in some of those other markets… We’re continuing to see migration from higher cost, higher tax markets—like Coastal California, Seattle, Portland, Boston, New York, DC, and Miami—into lower-cost markets.”

Heading into 2024 and 2025, the trend of varying inventory levels across the US housing market is poised to continue. Northern and coastal cities may struggle with relatively low inventory levels, while southern Sun Belt states are likely to continue expanding their housing offerings.

Moving Trends & Predictions

1. Politically motivated moves in 2024.

The United States is experiencing an accelerated rate of political segregation, contributing to considerable interstate divides. Notably, this trend is seeping into the housing market, impacting where citizens choose to live and buy homes.

In 2020, Realtor.com® collaborated with market research firm YouGov to gain insights into how political views influence these decisions. They surveyed 2,000 Americans, revealing the burgeoning link between political beliefs and residential choices. The study found that 55% of Americans perceive living among those with similar political perspectives as important. In contrast, 23% deemed this factor “not very important,” with the rest expressing neutrality.

Interestingly, these priorities vary across age demographics, with a considerable portion of young individuals (aged 18-34) stressing the importance of aligning their living situation with their political leanings.

As election season approaches, we can expect an uptick in politically motivated moves among homebuyers. While politics may not be explicitly stated as the driving force behind these relocations, citizens’ lifestyle choices invariably place them in communities dominated by their preferred political party.

Ryan Strickler, a political scientist at Colorado State University-Pueblo, succinctly summarizes this dynamic: “Democrats want to live in places with artistic culture and craft breweries, and Republicans want to move to places where they can have a big yard.”

2. Joint home purchases rise.

Faced with continued challenges in housing affordability, prospective buyers are increasingly considering joint home purchases. Unlike traditional home-buying, which often involves couples, this emerging trend encompasses broader collaborative arrangements including friends and extended family members.

This trend is reflected in the data provided by the National Association of Realtors. As of a 2022 report, unmarried couples represented 18% of all first-time homebuyers, a stark increase from just 4% in 1985. The demographic for these couples is predominantly millennials around the age of 32, with an average combined household income of $72,500.

Startups such as Arrived and Pacaso are capitalizing on the trend by facilitating co-ownership and fractional ownership deals, thus further normalizing and streamlining the process. Likewise, Joint Ventures (JVs) are gaining traction, whereby investors join forces to pool resources for property investments.

Anticipation is building that regulations around mortgages for joint purchases will become more flexible, carving out greater space for this burgeoning trend. The concept of “home” is becoming more fluid and shared, reflecting not only financial considerations but also the evolving cultural norms around property ownership and communal living.

3. North Carolina, Florida, and Colorado are attracting the highest interest from movers

In the past few years, the U.S. has seen a sizable shift in population dynamics. A significant number of people have been attracted to Sunbelt states, turning away from traditionally popular destinations. Among these, Texas and Florida stand out, with skyrocketing population growth.

In 2023, MoveBuddha released a report indicating North Carolina, Florida, and Colorado as the top states attracting newcomers based on mover searches exceeding 10,000. South Carolina topped the list of states that people moved to, according to data between January 1st and September 30th.

Several factors contribute to the alluring nature of these states. In South Carolina, for example, the affordable cost of living, 11.5% below the national average, has proven significant. Moreover, rapidly growing sectors like healthcare and technology in cities like Columbia, Greenville, and Lockhart have boosted South Carolina’s appeal within the job market. Finally, access to outdoor recreational activities, coupled with temperate climates, has increased demand for states like South Carolina, Tennessee, and Arkansas.

UHaul’s latest report supports these findings, with Texas attracting the most one-way U-Haul movers in 2023, securing its position on the U-Haul Growth Index for the third consecutive year. Florida closely follows, with North Carolina, South Carolina, and Tennessee making notable strides.

4. People are moving out of California, New Jersey, and Connecticut

UHaul’s report pointed out that, for four years running, California has seen the largest net loss of movers utilizing one-way rentals. This outbound trend isn’t isolated to the West Coast; Michigan, New Jersey, Illinois, and Massachusetts complete the bottom five states in terms of growth, with New York not far ahead, placed at 43rd.

MoveBuddha’s analysis for the period between January and September 2023 corroborates these findings. It shows a net outward movement from states like California, New Jersey, and Connecticut. High costs of living, extreme property tax rates – particularly in New Jersey where they’re the highest in the nation – and the relocation of corporate headquarters have fueled this migratory pattern.

It’s also worthwhile to note that while some cities continue to draw new residents, house prices in these growing locations are not necessarily increasing proportionally. A Bank of America research found that despite population growth in Austin, Texas, its housing market seems to be declining. The reason for this is that Austin’s mover demographic skews towards younger movers. This tends to inflate rental markets instead, as the incoming population may not be immediately participating in the home-buying market due to high mortgage rates and other economic pressures.

Home Building Trends & Predictions

1. Rise in builder confidence as interest rates drop

The U.S. housing market witnessed a slump in builder confidence back in 2023 due to rising interest rates and persistent supply chain issues. However, recent trends in 2024 have sparked cautious optimism among builders. Specifically, builder confidence in the newly built single-family homes market jumped up 7 points to hit 44 in January, according to data from the NAHB/Wells Fargo Housing Market Index (HMI). This consecutive increase in builder confidence coincides with a period of lowering interest rates.

January’s survey data showed that 31% of builders cut home prices, a significant drop from the previous two months at 36%, and the lowest since last August. Meanwhile, the average price reduction remained steady at 6%.

In addition, considerable effort was put into boosting sales through incentives. 62% of builders reported offering various sales incentives, a rate that has remained fairly stable since October.

Rick Sharga, spoke on the matter: “New home inventory if you’re looking at it in total is almost back to normal levels. The percentages are a little off, there’s still a slightly higher percentage of basically lots that have been permitted but the construction hasn’t started. Supply chain disruptions have kind of lessened and we still have a relatively low number of completed homes for sale. The builders are selling a lot of these homes while they’re still under construction.”

Given these trends in builder confidence and the present market situation, we can anticipate a potential rise in builder confidence going into 2025. If interest rates continue to stabilize or decrease, along with supply chain disruptions lessening over time, it may, in turn, increase the supply of new homes and nudge the housing market towards balance.

2. Cost of building materials will decrease year-over-year

The recent years have seen significant cost pressures in the housing market with soaring lumber prices and supply chain bottlenecks. However, as we step into 2024, the gloom is lifting somewhat thanks to a combination of slowing demand and increased production, which have led to a notable reduction in material costs.

December data revealed that the Producer Price Index (PPI) for softwood lumber fell by 2.3%—the third consecutive monthly decline and the fourth in the past five months—with an overall drop of 14.5% since its July 2023 peak. Lumber prices saw a 31.3% drop in 2023, following a 3.2% drop in 2022. Despite the over one-third cut over two years, prices still hover 22.7% above 2019 levels, due to a staggering 84.6% surge from 2019 to 2021.

Other materials like gypsum building materials and steel mill products are also hinting at a stable or downward price trend.

Gypsum’s PPI dipped by 0.3% in December and hasn’t risen since March 2023, closing the year with a 2.0% decrease. This was a modest change compared to the cumulative 44.6% increase of 2022.

Steel products, while having spiked by 3.3% in December (first rise since May), have averaged a 16.1% decline through 2023. This fluctuation followed an 8.7% increase in 2022 and a massive 90.3% hike in 2021. Prices were down 31.2% from their peak in 2021, yet they were still 65.1% higher than pre-pandemic figures from January 2020.

Note that price trends are subject to regional variations due to differences in market dynamics and typical construction methods.

3. Buyers will be attracted by sustainability

Sustainable building practices have transformed from being considered a luxury to a standard requirement in the U.S. housing market. Energy-efficient designs, eco-friendly materials, and smart home technologies are becoming increasingly prevalent. More and more, these sustainable choices are not only demanded by the younger generation of buyers, but also promoted by progressive builders who integrate green options into their construction strategies.

To put things into perspective, the single-family green buildings market is expected to grow to an estimated $275.36 billion by 2028, which shows a steady compound annual growth rate (CAGR) of 14.7%. A number of sustainable materials are being adopted in construction, including rammed earth, Mycelium for bricks, and bamboo.

Moreover, the trend of sustainable living extends beyond new construction to home renovations. Many homeowners are on a quest for increased sustainability, opting for low-flow plumbing fixtures, water-efficient appliances, and tankless water heaters.

In 2024 and 2025, sustainable building practices will become increasingly commonplace in the U.S. housing market. Factors like climate change, lower energy costs, and the desire for improved health and life quality drive this trend.

4. Builders continue to employ mortgage buydowns to attract buyers

In the face of rising interest rates and resultant affordability issues, a strategic approach is gaining popularity within the U.S. housing market: mortgage buydowns. Builders increasingly resort to this tactic, which involves temporary interest rate subsidies on behalf of the buyer, making monthly payments more affordable and attracting potential homeowners otherwise discouraged by high rates.

Forecasted to be a significant factor in 2024 and 2025, mortgage buydowns mostly involve the sellers, home builders, or occasionally the lenders, paying cash upfront to lower the mortgage rate for the buyer, generally by one to three percentage points.

There are two main types of buydowns: permanent and temporary. The Permanent buydowns, where buyers can pay down the rate with lender approval, are gaining relevance. These are contrasted by temporary buydowns, where an upfront fee is paid by the seller (or builder) to lower the buyer’s interest rate for a defined timeframe.

Rick, provides insight into why mortgage buydowns have become commonplace with builders: “It’s very shrewd for a couple of reasons, not the least of which is, it lets them not drop the list price of their homes. Not only would they lose money on that sale, but it would also make it harder for them to sustain that list price on subsequent sales.”

His observation underscores the dual advantage for builders: attracting more buyers and keeping their property value high.

There are big benefits to this for investors. The builders that we work with have discounted the interest rates so low that these new properties cash flow. It costs them, but it’s great for the investor.

Become a RealWealth member to view sample properties today.

Driving this trend are both the need for affordability on the buyer’s side and for active sales on the builder’s side. Moving forward, mortgage buydowns will likely continue to be an instrumental tool for builders, buyers and investors alike, helping maintain a favourable momentum in the U.S. new build housing market.

Additional Housing Market Predictions for 2026 to 2028

1. Rising incomes and dropping mortgage rates will help restore affordability

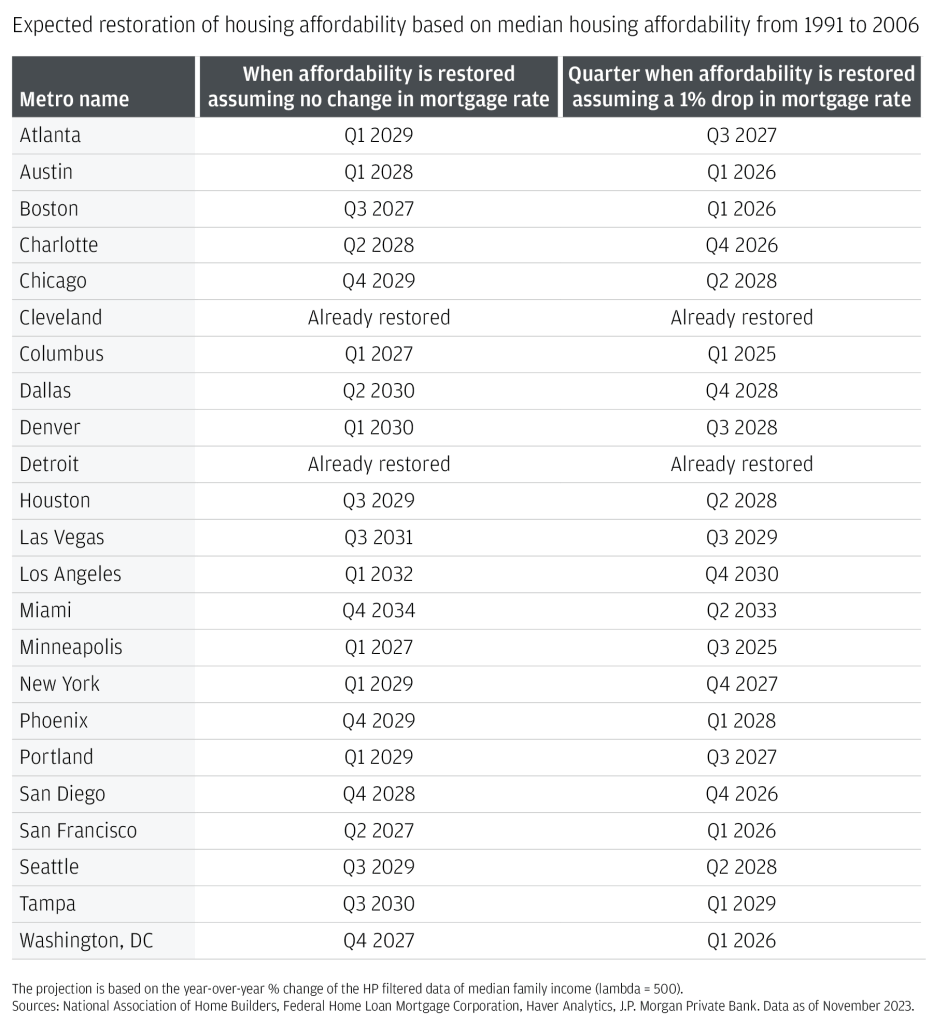

The US housing market is expected to see a gradual improvement in affordability over the next few years, according to recent economic projections. JP Morgan’s analysis suggests that if incomes continue to rise steadily and mortgage rates remain unchanged, housing affordability could be restored in an average of 3.5 years nationally, and in 5.3 years for large metro areas.

Currently, the housing market is facing affordability challenges, particularly in large cities where land is scarce and zoning restrictions limit new development. However, if income growth continues at its recent pace, it is expected to help restore housing affordability over time.

“The years-to-affordability calculation for cities diverges widely, ranging from zero years for Cleveland/Detroit to more than 10 years for Miami,” says the JP Morgan report. This suggests that some cities will take longer than others to recover from the current affordability crisis.

Source: JP Morgan

Mortgage rates are predicted to gradually fall between 2024 and 2028, but are unlikely to fall under 5.0% due to rising government debt in the US and around the world crowding out the availability of financing.

Overall, while the housing market is expected to see a gradual improvement in affordability over the next few years, it is important to note that affordability challenges will continue to vary across different cities and regions. Income growth and mortgage rates will play a crucial role in determining the pace of improvement in housing affordability.

2. Modular construction on the rise

In recent years, traditional construction methods have been challenged by a perfect storm of labor shortages and a surge in material costs. In response, the construction industry has begun to pivot towards modular construction, a process that relies on pre-manufactured modules which are assembled on-site, promising improved efficiency, faster build times, and potentially lower costs. While pilot projects using this approach have been successful, the transition to larger scale operations poses its own set of challenges.

The US modular construction market is gaining steady ground and is forecasted to reach a valuation of USD 19.17 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.8%. This growth is being catalyzed by several factors: the increasing demand for housing among a growing number of migrants, investments in sustainable and cutting-edge technologies, and a marked preference for eco-friendly manufacturing processes.

Typically, modular construction involves pre-constructing 60-90% of a structure before it is transported to the final site. This process significantly reduces on-site construction time and can shield projects from the unpredictability of the weather, which often causes delays in traditional construction.

As the industry evolves between 2026 to 2028, modular construction is expected to cross the threshold from an alternative method to the mainstream, particularly within key market segments such as multi-family and student housing. The modular approach not only stands to streamline the construction process but is also in tune with the global shift towards sustainability and resource efficiency.

3. Multifamily housing supply expected to drop sharply by 2026

The US housing market has experienced sustained growth in demand for both industrial spaces and multifamily housing units. However, recent trends indicate a significant deceleration. According to Lee & Associates’ 2023 Q3 North America Market Report, the multifamily sector has witnessed a spike in vacancies accompanied by the lowest rent growth on record.

One factor attributed to this downturn is the rapid construction rates that have outpaced demand in certain markets. This has potentially led to overbuilding and oversupply, particularly evident in the multifamily market segment. Lee & Associates highlight that over one million multifamily units are currently under construction across the US, the highest number since the early 1970s. Currently, there has been a notable decline in new starts due to factors like surging interest rates, diminishing rents, and sector overbuilding.

While construction starts have waned, projections for 2026 show far fewer completions, estimated at fewer than 160,000 units, and about 194,000 units anticipated for 2027. This marks a stark contrast to the projected completions in 2024 and 2025, nearly 440,000 and 335,000 units, respectively.

Economists at Yardi Matrix have a slightly different viewpoint, predicting a rise in construction completions in the next couple of years after a peak in construction starts in May 2023. However, Yardi’s forecast also notes a plateau in both planned and prospective projects from Q3 2023.

Senior Research Analyst Ben Bruckner of Yardi Matrix comments on this trend, “After an unwavering period of expansion, the multifamily market is recalibrating. Our baseline forecast sees new supply hitting its lowest point in 2026 with around 377,000 units, while a possible downside forecasts a bottoming out at 335,000 units.”

In summary, the downward trend in multifamily housing construction in the US market suggests a period of correction and rebalance. As the market adjusts, key factors such as fiscal policy, economic conditions, and consumer behavior will play crucial roles in shaping the direction of multifamily housing inventory moving forward.

4. Rising homelessness will compel changes to zoning laws

The number of people experiencing homelessness in the United States is on the rise, and it’s likely to continue to grow over the next five years.

In 2022, HUD reported around 582,000 Americans experiencing homelessness. That’s about 18 per 10,000 people in the US, up about 2,000 people from 2020. It’s also estimated that around 3.7 million people live in “doubled-up” situations with family and friends due to inability to afford housing.

In response to this growing crisis of homelessness and high housing costs, several cities and states have altered zoning laws to allow developers and homeowners to build more housing units on single-family lots. This trend will continue as more cities and suburbs face these same problems.

Over the next five years, accessory dwelling units built next to existing homes and smaller multifamily buildings replacing single-family homes will become more common, especially in dense urban cores.

5. Many real estate agents will drop out or switch careers

Our final housing market prediction is courtesy of Firsttuesday, a provider of real estate sales licensing and continuing education. They predict a dramatic fall in sales agent licensing from 2023 to 2025. Their prediction is based on the assumption that reduced sales activity will lead to fewer people pursuing careers as real estate agents. However, they believe that sales agent licensing will start rising again in 2028 as more buyers and speculators enter the market.

Final Thoughts

In conclusion, the housing market predictions for the next 5 years (2024-2028) suggest a continued trajectory of steady growth, albeit at a moderate pace. We have shed light on various critical aspects, including mortgage rates, housing prices, new construction, and moving trends.

These real estate market predictions indicate that interest rate cuts towards the second half of 2024 will have a positive impact on buyer demand and builder confidence. Employment growth is expected to remain steady, and migration trends, fueled by affordability, wider spaces, and remote work, will continue to shape the housing market.

While home prices are expected to increase marginally, multifamily rents may remain stagnant year-over-year in 2024. The persistent lack of inventory and low affordability in the housing market are expected to continue until 2028, when supply and demand are projected to become balanced.

Note that these real estate market forecasts are based on current trends and expert opinions, and are subject to change due to unforeseen economic and political developments. See our top picks for best places to buy investment properties in 2024.

Housing Market Prediction FAQs

1. Will the housing market crash in the next 5 years?

While a major crash like 2008 is unlikely due to stricter lending regulations, a slowdown or moderate price correction is possible. Rising mortgage rates and economic uncertainty may dampen affordability and demand, leading to slower price growth or even slight dips in some regions. However, factors like tight inventory and high population growth in certain areas could still put upward pressure on prices.