Where are the best places to buy rental property this year? As a seasoned real estate investor who has been buying single-family and multi-family real estate for decades in the United States and abroad, this is a question I get asked a lot. To help you narrow down the best market for your real estate investment goals, we’ve rounded up the top choices for 2024 and into 2025.

Best Places to Buy Rental Property Quick Links

Before we dive into our best places to buy rental property for 2024, here are some tips for analyzing potential real estate markets.

3 FACTORS FOR ANALYZING A REAL ESTATE MARKET

Before researching and analyzing markets, you’ll want clarity on your real estate investment goals to avoid making impulse decisions. Ask yourself, “What do I want from my investment?” Knowing your goals and the answer to this question is critical to creating your best real estate investment strategy.

long term investing

I’ve found that the best cities to invest in have three factors in common: job growth, population growth and affordability.

1. Job Growth

Because population growth correlates with the availability of job opportunities, real estate investors should prioritize markets where job opportunities are expanding.

When assessing a location for a strong job market, here are key points to keep in mind:

- Number of jobs. The amount of jobs in an area signifies which locations are experiencing growth and which are not.

- Rise in median salary. The median salary is the midpoint of all wages. When it rises, it indicates a growing economy with a demand for skilled workers.

- Job diversity. A strong mix of industries and workforce signifies an area is on an upward momentum.

- Commercial buildings. When the economy improves, industries expand and more commercial buildings and towers are built.

2. Population Growth

Despite what the numbers on your pro forma may say, a rental property only brings in revenue if you can find someone willing to rent it. To determine the best places to buy rental property for 2024, look for areas with high population growth and housing demand.

To analyze a region’s real estate market, look for signs of increasing population, as this often equates to increased demand for housing. Real estate markets with growing populations also tend to have strong economies. When more jobs are available, more people can afford to pay rent.

When demand for houses outpaces supply, home prices rise and rents increase. When you invest in rental properties in an area with high population growth and housing demand, your investment should pay off over time as rents rise.

3. Affordability

Every housing market has its own pricing and market trends. When researching where to invest in rental property, different factors come into play. Here are three you’ll want to make note of:

- Location. A property’s location, including the city and neighborhood, plays a big role in its current value, appreciation potential, and how long it takes to recoup your initial investment. At RealWealth, we suggest investors avoid high-priced markets like New York City, Los Angeles, or San Francisco and instead focus on markets with growing appreciation and job growth like Baltimore, Maryland, San Antonio, Texas, and Jacksonville, Florida.

- Price-to-rent ratio. Investors use this benchmark number to gauge an area’s potential profitability. To find this number, divide the median home price by the median yearly rent. The calculated number lets you know if renting or owning a property is cheaper. A price-to-rent ratio of 15 or lower favors buying, while 21 and above means it’s cheaper to rent than buy. The higher the price-to-rent ratio, the worse the market is for real estate investing (rentals in particular). It also translates to lower cash flow potential. Conversely, an area with affordable real estate but increasing rents will almost always make for a good investment.

- Fixer Upper. A fixer-upper in a popular or up-and-coming neighborhood can also be a good investment if you have the time, money and experience to make improvements that increase rent and property values.

When you find a market with all three factors – job growth, population growth, and affordability – you’ll likely be able to find good real estate investment opportunities for both cash flow and appreciation.

To help you with your market research, we’ve rounded up 25 of the best places to buy rental property for 2024 and into 2025. We’ll also explain why these markets are strong for investors.

WHERE IS THE BEST PLACE TO BUY RENTAL PROPERTY?

25 CITIES TO CONSIDER IN 2024 AND INTO 2025

Please Note: The following real estate markets are ranked according to our estimation of their cash flow and appreciation potential. We’ve made this determination based on insights from RealWealth Investment Counselors, who are highly experienced real estate investors who own property in many of these markets.

Using the expertise of our local property team networks, we’ve pulled together and analyzed current home value and rental data based on the current inventory, as well as metro area historical home value and rental data (dating back to 2014) using Zillow’s Housing Data spreadsheets. In addition, we’ve researched and calculated metro population growth for the last eleven years using Census.gov and annual job growth using data from the Department of Numbers.

We’ve completed months of research to update this article for 2024. However, please do your due diligence when deciding which real estate market to invest in and which property to purchase. This is the only way to ensure you make the best investment decision for your goals and financial situation.

#1 – Dallas, Texas

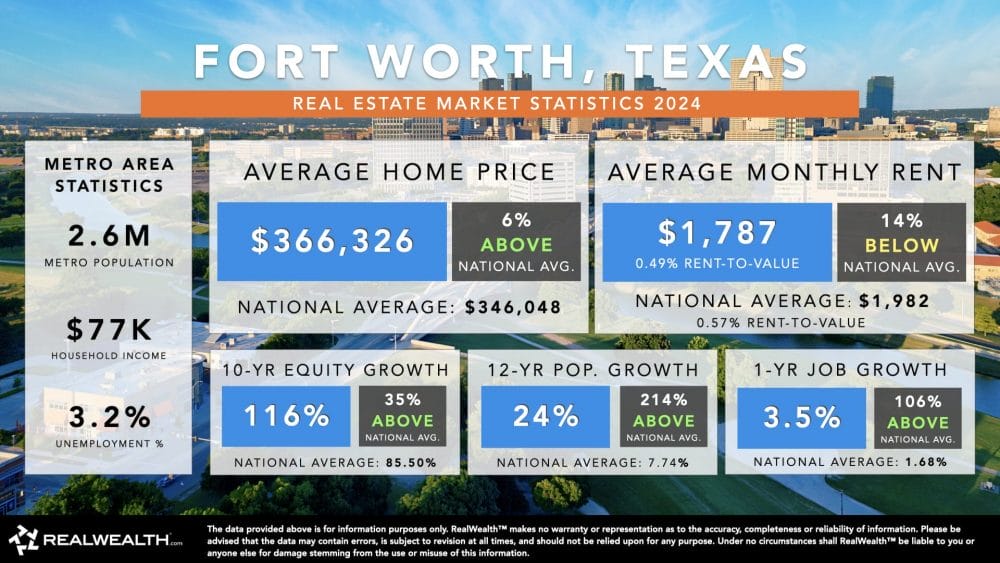

Often referred to as DFW or The Metroplex by locals, the Dallas–Fort Worth–Arlington Metropolitan Statistical Area is the bustling hub of North Texas. It covers 12 counties, with two main areas—Dallas–Plano–Irving and Fort Worth–Arlington—leading the economic growth of Texas.

It is anticipated to be America’s third-biggest metro area by 2030, with a projected population of up to 10 million residents. Currently ranked fifth for its economic size among other U.S. metro areas, Dallas had a gross domestic product (GDP) of approximately 688.9 billion U.S. dollars in 2022, clearly showing a continuing economic growth and stability trend in one of the best investment property locations.

About the Dallas Housing Market

Dallas’s real estate market has evolved thanks to forward-thinking development and a diverse economy. Although it was once known for cotton and oil, Dallas has expanded into other industries, such as tech and finance. This diversity has helped the real estate market stay strong. The Dallas housing market has remained stable, even during economic uncertainty, making it a good choice for investors.

According to a recent PwC/Urban Land Institute report, Dallas-Fort Worth ranked fifth in homebuilding prospects and third in overall real estate prospects nationally. These rankings highlight Dallas-Fort Worth as a key ‘Super Sun Belt’ city and a magnet for real estate investment.

With the most multi-family units in 2022 and a healthy vacancy rate of 6.1%, Dallas-Fort Worth has a well-balanced supply and demand. This means real estate in Dallas is still more affordable for investors than other large metro areas, making it one of the best cities to buy rental property.

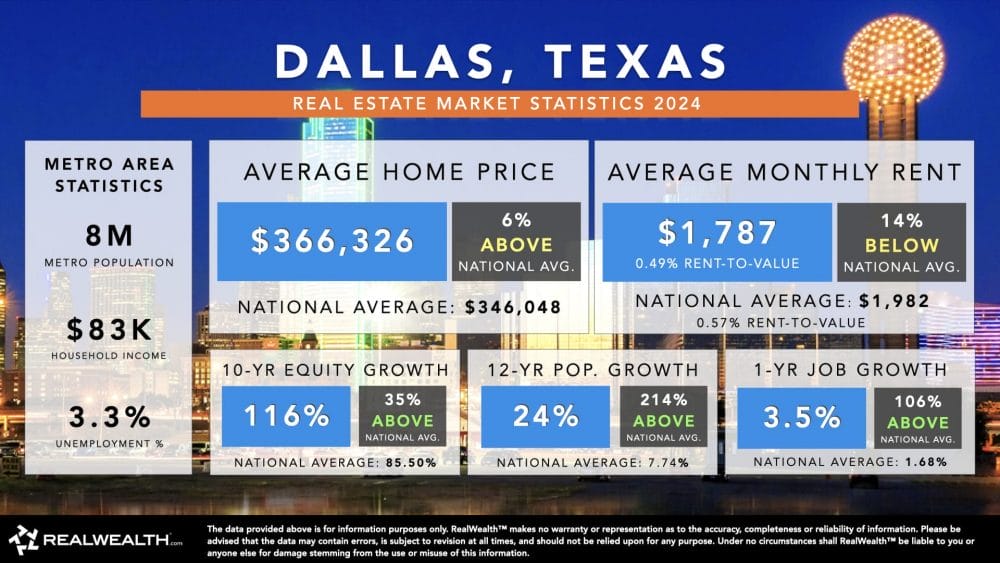

Dallas Housing Market Statistics

- Median Household Income: $82,823

- Metro Population: 7.9 Million

- 12-Year Population Growth: 24.27%

- Median Home Price: $366,326

- Median Rent Per Month: $1,787 (0.49% rent-to-value ratio)

- 1-Year Equity Growth: 8.91%

- 10-Year Equity Growth (January 2014 – January 2024): 115.52%

- 1-Year Rent Growth: 4.07%

- 10-Year Rent Growth (January 2014 – January 2024): 43.19%

- Job Growth: +144,399 CES jobs created over the last year

- 1-Year Job Growth Rate: 3.46% (106% higher than the national average)

- Unemployment Rate: 3.3% (11% lower than the national average)

Dallas Housing Market Quick Facts

- Home prices in the Dallas metro area have grown by an impressive 115.52% over the last 10 years at a rate of 8.91%, making it one of the fastest-appreciating housing markets in the country. However, Realtor.com ranks Dallas as the 96th top housing market for price growth in 2024, indicating that price growth has slowed.

- Rents have steadily increased by 4.07% per year over the last decade. As of January 2024, the average rent for single-family rental properties in Dallas is $1,787.

- Dallas’s economy is vibrant, diverse, and expanding, as reflected by a 3.46% job growth rate as of October 2023. Between October 2022 and October 2023, 144,400 new jobs were created.

- The Dallas-Fort Worth metro area is one of the fastest-growing in the US, with a population growth of over 24% in the last 12 years, projected to surpass 8.2 million by the end of 2024

- The Dallas metro area’s GDP grew by 12.8% to $688.9 billion between 2021 and 2022, highlighting the region’s economic strength.

- The Dallas housing market is heating up, as evidenced by its market hotness rank change of -27 compared to other metro areas, indicating a significant rise in the market’s ranking.

- Despite a recent slowdown with a 0.7% decline in home prices as of January 2024, the Dallas real estate market has shown signs of increased activity, with a 7.6% rise in active listings and a 2.9% increase in new listings.

- The rental vacancy rate in the Dallas metro area stands at 6.1%, with 41% of metro households opting to rent.

Top 3 Reasons to Invest in the Dallas Real Estate Market in 2024

1. Resilient appreciation

Despite forecasts of home price stabilization, the Dallas housing market has consistently surpassed the national average, with an average yearly home price appreciation rate of 8.91% and an average rent appreciation rate of 4.07% over the last 10 years. This reliable growth offers promising investment opportunities, even during periods of price corrections.

2. Rapid urbanization and population surge

The Dallas-Fort Worth metro area is among the fastest-growing regions in the United States, with a population increase of over 170,000 people between July 2021 and July 2022. The city of Dallas has gained 100,000 residents in the last decade. This rapid urbanization indicates a strong and sustained demand for housing.

3. Diversified economic powerhouse

Dallas boasts a flourishing, diversified economy that goes beyond any single industry. As the fifth fastest-growing economy among the 50 largest metro areas in the U.S., Dallas attracts businesses, talent, and investment, driving job creation and supporting the housing market’s growth potential.

How To Purchase Investment Property in Dallas

Dallas has a robust and diversified economy with a significant presence in the technology, financial services, and defense sectors. The city’s population growth and job market are strong, contributing to a high demand for rental properties.

How to Purchase:

- Research the market: Familiarize yourself with the different neighborhoods and their investment potential. Areas like Bishop Arts District and Deep Ellum are popular for their vibrant community and potential for growth.

- Understand the laws: Texas property laws are generally landlord-friendly. However, be aware of specific local regulations regarding property rental and maintenance.

- Financial planning: Texas property taxes are higher than in other states, which could impact your investment’s profitability. Review your real estate pro forma thoroughly and talk with a trusted CPA.

- Work with a local team: Partner with experts who know the Dallas market well and can help you find the best properties. Sign up to RealWealth to connect with the team we work with in the Dallas metro area.

Best Neighborhoods to Invest in Dallas

1. Denison: Located 60 miles north of Dallas, Denison is part of the thriving Sherman-Denison metro area. What makes Denison attractive to investors is the upcoming $4 billion, 3,100-acre Preston Harbor master-planned community, which will bring a resort hotel, retail, restaurants, an upscale marina, and around 7,500 homes ranging from luxury single-family to apartments and condos. This large-scale development signals significant growth and appreciation potential for real estate investors in the area.

2. Greenville: Northeast of Dallas, the city of Greenville offers a compelling mix of small-town charm and strategic connectivity to the larger Dallas-Fort Worth-Arlington metropolitan area.

Greenville is home to about 30,000 residents and has witnessed booming construction activity over the last two years. With major employers like L-3 Communications, McKesson, Solvay, and Weatherford International in its vicinity and close to Hunt Consolidated Investments in Dallas, Greenville represents an attractive investment locale with potential for economic expansion.

3. Mabank: Situated 50 miles east of Dallas, Mabank is also experiencing a building boom. Its small-town charm and proximity to tourist attractions like Lake Whitney State Park create potential for short-term rental investments. Mabank’s home prices are also more affordable than many other areas in Dallas. It is an up-and-coming area with solid investment prospects.

#2 - Jacksonville, Florida

Jacksonville, Florida, is the 12th largest city in the United States. Its population is over 948,000, and the metro area has a population of 1.6 million. The city’s growing population and attractions make it an appealing destination for people moving from higher-cost regions, particularly the Northeast. As of January 2024, the average home price in the metro area is $351,548, slightly above the national average.

The city’s economic stability is another factor that attracts real estate investors to one of the best cities to buy rental property. Jacksonville’s diversified industrial base includes finance, healthcare, logistics, and manufacturing. This mix of industries ensures that the area’s employment and economic prospects are not tied to the fortunes of a single sector, making it a well-rounded choice for investment.

About the Jacksonville Housing Market

From 2009 to 2014, a period marked by relatively little multi-family construction, the housing crisis led to an increase in rental households. This contributed to declining vacancy rates and rising rents in Jacksonville, setting the stage for its current real estate boom.

Despite a surge in multi-family construction from 2015 onwards, rising rents continued. This was partially due to an influx of migrants into the Housing Market Area (HMA), which resulted in a tighter rental market and positioned Jacksonville as a thriving real estate investment hotspot.

Over the last ten years, the area has added more than 100,000 residents. This influx of new residents is particularly pronounced in St. Johns County, where the population has increased by 44%. This higher-than-average level of net in-migration has resulted in much more substantial population growth, averaging 30,900 people or 2.1% annually from 2013 to the present.

As of January 2024, the median home price within the city is $290,000, an increase of 3.2% year-over-year. This combination of relatively low home prices, high rental rates, and significant property appreciation rates makes the Jacksonville real estate market one of the best places to buy rental property.

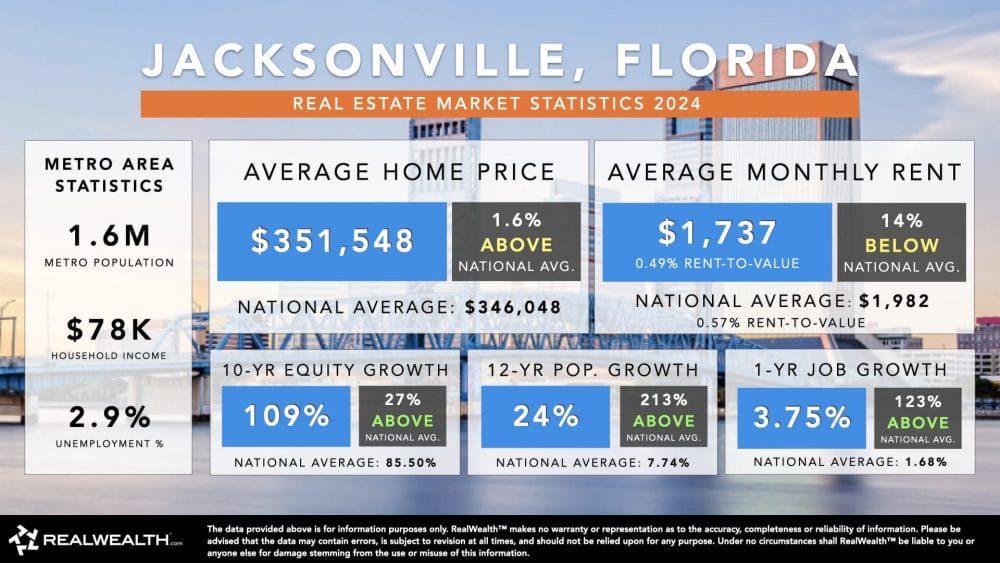

Jacksonville Housing Market Statistics

- Median Household Income: $77,583

- Metro Population: 1.6 Million

- 12-Year Population Growth: 24.22%

- Median Home Price: $351,548

- Median Rent Per Month: $1,737 (0.49% rent-to-value ratio)

- 1-Year Equity Growth: 8.53%

- 10-Year Equity Growth (January 2014- January 2024): 108.85%

- 1-Year Rent Growth: 5.06%

- 10-Year Rent Growth (January 2014 – January 2024): 55.98%

- Job Growth: +29,400 CES jobs created over the last year

- 1-Year Job Growth Rate: 3.75% (123% higher than the national average)

- Unemployment Rate: 2.9% (22% lower than the national average)

Jacksonville Housing Market Quick Facts

- With an average single-family home price of $351,548, the Jacksonville market has experienced remarkable appreciation, growing by 108.85% over the last 10 years at an annual rate of 8.53%.

- Rental rates have grown substantially, with the average single-family rent reaching $1,737. Over the last decade, rental prices have increased by 55.98%, growing at a rate of 5.06% per year.

- The Jacksonville metro area experienced an impressive 3.75% annual job growth between October 2022 and October 2023, adding 29,400 jobs.

- The population of the Jacksonville metro area has also expanded by 24.22% over the last 12 years – a rate that is 213% faster than the national average. Currently home to 1.67 million residents, the Jacksonville metro area is growing at an annual rate of 2.19%.

- Realtor.com reports that as of January 2024, home prices in Jacksonville have increased by 5.2% year-over-year, with active and new listing counts rising by 8.5% and 9.8%, respectively.

- The rental market in Jacksonville has maintained a relatively high vacancy rate of 12.5% as of Q4 2023, up from 7.8% in the previous quarter. 33.3% of households in the area are renters.

- The Jacksonville metro area ranks as a “hot” market, with a market hotness rank change of -30 compared to other metro areas nationwide as of January 2024. This suggests that the market is heating up.

- The Jacksonville metro area’s GDP totals $117.1 billion, and it grew robustly by 12.1% between 2021 and 2022.

Top 3 Reasons to Invest in the Jacksonville Real Estate Market in 2024

1. Fast population growth

The Jacksonville metropolitan area has experienced remarkable population growth, with the metro’s population reaching an estimated 1.68 million as of October 2023. Over the past 12 years, the metro area has seen a 24.2% growth rate, more than double the national average.

This rapid influx of new residents is driven by Jacksonville’s lower cost of living, diverse economy, and appealing lifestyle, with year-round warm weather and proximity to beaches. The city of Jacksonville itself has seen a 5% population increase from 2019 to 2021, coupled with a 12.8% rise in median earnings, signaling a thriving economy and a real estate market poised for both rental and sales growth.

2. Robust job market

Jacksonville’s strategic location and infrastructure have made it a hub for logistics, transportation, and other key industries. The metro area added 30,200 jobs in November 2023 alone, representing a 3.8% year-over-year increase that outpaced both the state and national averages.

With an unemployment rate of just 3.2%, well below the national and state levels, Jacksonville offers a stable and growing job market. The expansion of the Jacksonville Port Authority, major financial and technology companies, and significant military and healthcare sectors contribute to the city’s economic vitality and job creation potential.

3. Steady real estate appreciation

Population growth and a robust job market have fueled strong demand for housing in the Jacksonville metro area. While the market may be cooling slightly, the city of Jacksonville still saw a 3.2% year-over-year increase in home prices as of January 2024, according to Redfin.

Over the past decade, the median home price in the metro area has increased by an impressive 108.85%, and rent prices have risen by 56%. In the city of Jacksonville, home prices have appreciated by an even more substantial 144.53%, indicating a steady and significant rise in property values. With consistently positive residential builder sentiment, the Jacksonville real estate market remains an attractive investment opportunity.

How To Purchase Investment Property in Jacksonville

With beautiful beaches, a warm climate, and a growing tech scene, Jacksonville attracts young professionals and families. This growth drives the demand for both single-family and multi-family rental properties.

How to Purchase:

- Market research: Look into areas like Riverside and San Marco for higher-end investments or Westside for more affordable options.

- Regulations to consider: Florida does not have a state income tax, which can benefit rental income. However, due to hurricane risks, consider insurance costs, especially for properties close to bodies of water.

- Build a network: Connecting with local real estate agents and investors can provide valuable insights into the market and help you find good deals. Sign up to RealWealth to connect with the team we work with in the Jacksonville metro area.

Best Neighborhoods to Invest in Jacksonville

1. Downtown Jacksonville: As the heart of the 1.6 million-strong Jacksonville metropolitan area, Downtown Jacksonville offers a unique investment opportunity. Situated along the scenic St. Johns River, the area provides access to recreational amenities like the Riverwalk and a thriving commercial landscape.

Home to three Fortune 500 companies and over 2,400 businesses, Downtown boasts a daytime population of 55,000 employees. With ongoing revitalization projects, including the $145 million FIS headquarters and the $72.2 million JEA headquarters, Downtown Jacksonville is poised for continued growth and investment appeal.

2. Inverness: Located approximately 80 miles north of Jacksonville, the Inverness area presents a compelling option for real estate investors seeking more affordable opportunities. As part of the Homosassa Springs metro but within the broader Jacksonville metropolitan region, Inverness offers lower home prices compared to the core Jacksonville market.

Inverness is home to major employers like Florida Citrus Hospital and Advance Green Energy, providing a stable economic foundation. For investors looking to diversify their portfolios with more budget-friendly options, Inverness is worth considering.

3. Orange Park: Situated along the picturesque St. Johns River, the suburb of Orange Park offers a unique blend of tranquility and convenience. With a population of 8,600, Orange Park provides residents with a family-friendly atmosphere and easy access to the amenities of Downtown Jacksonville.

The area is home to one of the largest shopping malls in the country, the Orange Park Mall, which features a diverse array of retail and entertainment options. Investors in Orange Park can capitalize on the high occupancy rates and steady rent growth driven by the area’s desirable residential character and excellent school system.

#3 – Ocala, Florida

Located in the heart of Florida, Ocala has seen impressive population growth, with a net migration increase of over 14,030 people between July 2021 and June 2022. This growth ranks the Ocala metro area among the top 10 fastest-growing metropolitan areas in the United States.

This rapid population influx is due to a combination of factors, including the area’s affordability, job opportunities, and overall quality of life. With a median home price 21% lower than the national average, Ocala offers an attractive entry point for investors looking to capitalize on the region’s real estate potential.

The arrival of major employers like Amazon and Lockheed Martin has created a wealth of employment prospects, further driving housing demand in one of the best places to buy rental property.

About the Ocala Housing Market

Ocala’s real estate market has been on an impressive trajectory in recent years. In Q4 of 2021, the Ocala metro area was the second-ranked metro area with the most significant gain in existing single-family home prices, highlighting the region’s desirability.

However, the market has shown signs of cooling, with home prices down 15.8% compared to the previous year and homes taking an average of 43 days to sell, up from 40 days last year. Despite this slight cooling, Ocala’s housing market remains highly competitive, driven by the area’s proximity to larger cities like Orlando and Gainesville.

Ocala’s diverse economy includes healthcare, manufacturing, education, and tourism tourism, providing a stable foundation for the local housing market. The presence of new construction projects in the area also signifies a growing housing market, presenting investors with a wealth of opportunities for good rental property areas.

Ultimately, Ocala’s livability, including its affordable living costs and high quality of life, makes it an attractive location for both renters and property investors.

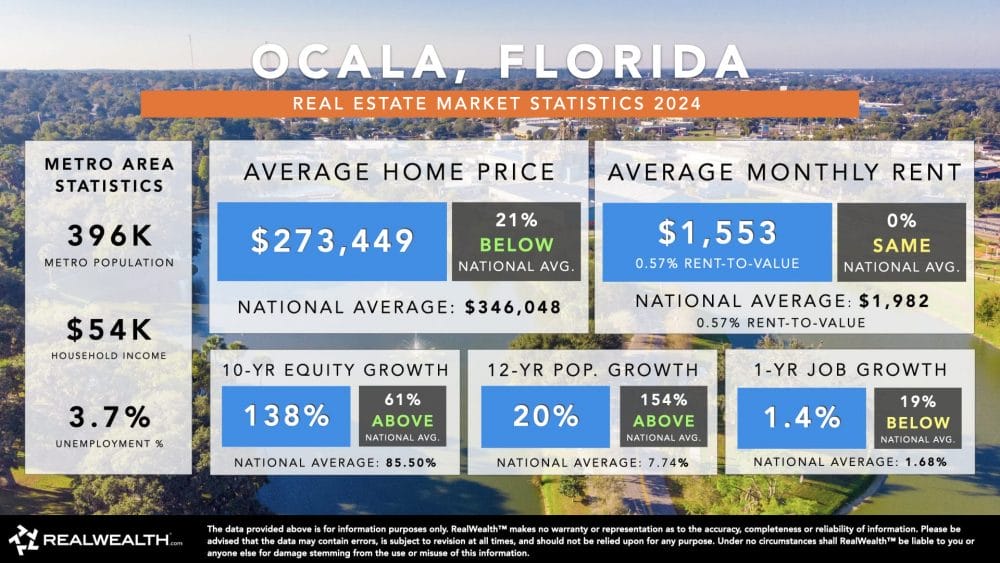

Ocala Housing Market Statistics

- Median Household Income: $54,190

- Metro Population: 396,415

- 12-Year Population Growth: 19.64%

- Median Home Price: $273,449

- Median Rent Per Month: $1,552 (0.57% rent-to-value ratio)

- 1-Year Equity Growth: 10.1%

- 10-Year Equity Growth (January 2014 – January 2024): 82.65%

- 1-Year Rent Growth: 6.92%

- 10-Year Rent Growth (January 2014 – January 2024): 82

- 65%

- Job Growth: +1,600 CES jobs created over the last year

- 1-Year Job Growth Rate: 1.35% (19.5% lower than the national average)

- Unemployment Rate: 3.7% (same as the national average)

Ocala Housing Market Quick Facts

- The average home price in the Ocala metro area is $273,449, marking a remarkable increase of 137.59% over the last decade—a yearly appreciation rate of 10%. Despite steep price appreciation, homes in Ocala are still more affordable than other metro areas in Florida.

- The average rent in the Ocala metro area is $1,552, representing a total increase of 82.65% in the last decade or an annual growth rate of 6.92%.

- In the Ocala metro area, 21.5% of households are occupied by renters, and the current rental vacancy rate in the city is 5.1%, according to Point2.

- Between July 2010 and July 2022, the metro area’s population growth was 19.64%, indicating a steady annual growth rate of 1.81%. With a projected population of 410,892 by the end of 2024, there’s potential for increased demand in the Ocala housing market.

- Given Ocala’s large retiree demographic, the area has reported slow job growth. Specifically, between October 2022 and October 2023, about 1,600 new jobs were created, representing a job growth rate of 1.35%—around 20% lower than the national average.

- As of January 2024, the Ocala metro area had a market hotness rank change of -10 compared to all other metro areas nationwide, indicating that the market is heating up.

- Realtor.com reports that from January 2023 to January 2024, although the median listing price in Ocala slightly decreased by 0.94%, there was a notable increase in active and new listing counts—27.8% and 22%, respectively.

- Ocala’s GDP is $14 billion. The Ocala metro area’s economy grew 9.1% between 2021 and 2022.

Top 3 Reasons to Invest in the Ocala Real Estate Market in 2024

1. Affordable real estate prices

The Ocala metropolitan area is an exceptionally affordable real estate market, with a median home price of $273,400 – significantly lower than the national average of $346,000 and Florida’s average of $389,000.

Redfin recently ranked Ocala the most affordable place to live in Florida, making it an attractive destination for homebuyers and investors seeking budget-friendly options compared to popular Florida metros like Naples, Miami, and Fort Lauderdale. Additionally, Ocala has the second-highest number of new construction homes planned, with 5,318 single-family permits issued in 2022, signaling a robust and expanding housing market. Both earn this Florida destination as one of the best places to buy renal property.

2. Fast population growth

The Ocala metropolitan area has experienced remarkable population growth, with the population in the Ocala MSA expanding by an astounding 482.93% between 1969 and 2022, outpacing both Florida and the nation’s growth rates. This rapid influx of new residents is driven by Ocala’s central Florida location, offering proximity to beaches, theme parks, and major cities like Orlando and Tampa, as well as a lower cost of living that attracts retirees and younger families.

Ocala’s growing job market, particularly in healthcare, tourism, and logistics, further fuels this population boom, creating strong demand for housing.

3. Strong home price and rent appreciation

While the Ocala housing market has seen a slight price adjustment in 2023, with the median sale price decreasing by 16% compared to the previous year, the area’s long-term appreciation trend remains highly positive. Over the last decade, Ocala has experienced home price appreciation of 137.6% and rent appreciation of 82.65%. This steady growth, combined with the area’s affordability compared to neighboring regions and high yield rentals, makes Ocala’s rental market an attractive investment opportunity.

How To Purchase Investment Property in Ocala

Known for its thoroughbred horse farms, Ocala is a smaller market that offers a more affordable entry point for investors. The area is experiencing growth in manufacturing and logistics, enhancing job opportunities and the demand for housing.

How to Purchase:

- Research location: Areas close to major employers and the downtown district offer potential due to their popularity among renters.

- Regulatory considerations: Understand statewide regulations while paying attention to specific local zoning laws or development plans.

- Research equestrian-friendly properties: Evaluate the potential for horse-related property investments.

- Work with experts. Work with a team that knows the local market. Sign up to RealWealth to connect with the team we work with in the Ocala metro area.

Best Neighborhoods to Invest in Ocala

1 . Silver Springs Shores: This community within the Ocala metropolitan region is popular for its affordability, making it an excellent starting point for investors looking to build or expand their portfolios. The area’s appeal to snowbirds, retirees, tourists, and short-term vacation renters creates a consistent demand for rental properties.

Additionally, part of Silver Springs Shores is located within an Opportunity Zone, offering potential tax benefits for eligible investments. With a population of 25,000 and a mix of ranch-style and contemporary bungalow homes, Silver Springs Shores provides a variety of investment opportunities.

2. Southeast Ocala: Investors seeking cash flow potential would do well to consider the Southeast Ocala region. This area generally offers lower property prices than other parts of the Ocala metro. Conveniently located near major roads, shopping centers, and recreational areas, Southeast Ocala is experiencing steady growth, with new developments and infrastructure projects enhancing its appeal.

In addition to rental properties, the area also presents opportunities for land investment, with available lots within gated subdivisions, allowing for build-to-suit options that could yield significant upside potential for developers.

3. Belleview: Located about 15 miles south of Ocala, Belleview offers investors a unique opportunity to capitalize on a suburban setting with easy access to the larger metropolitan area.

With a population of 5,650 as of July 2022, Belleview is a charming community that could attract those seeking a peaceful, picturesque place to live. The rental market in Belleview is robust, with low vacancy rates, and the area is family-friendly, with good schools and amenities. Investors can also benefit from Belleview’s proximity to the Ocala National Forest and other attractions, which draw visitors and create potential for short-term rental opportunities.

#4 - San Antonio, Texas

San Antonio and the surrounding New Braunfels area are experiencing rapid population growth. In fact, from 2020 to 2021, San Antonio had the highest population growth of any city in the United States. The city’s economy is strong and diverse, with sectors such as healthcare, tourism, the military, and technology, making San Antonio one of the best places to buy rental property.

San Antonio is also known for its rich cultural heritage, which is well-preserved and adds to the city’s charm. This culture and the thriving economy create a vibrant and appealing community.

The San Antonio real estate market is also affordable. As of January 2024, the median home price in the area is $281,632, which is about 19% lower than the national average. Affordability and the city’s solid economy and population growth make the San Antonio-New Braunfels metro area a compelling choice for purchasing rental property.

About the San Antonio Housing Market

San Antonio has been ranked among the top ten cities in the PWC and ULI Emerging Trends in Real Estate report for 2024. It came in at number eight out of 80 cities and two for home-building prospects. The city’s diverse and recession-resistant economy, major economic developments, and track record of attracting new residents all contribute to this growth.

As of January 2024, home prices in San Antonio have decreased slightly by 3.8% from the previous year, with a median home price of $250,000 and an average of 55 days on the market. This temporary downturn presents an opportunity for investors looking to enter the market at a lower price point. Despite this short-term softening, the city’s long-term growth prospects remain strong, thanks to its large military presence and growing healthcare and tech sectors.

San Antonio’s housing market has a history of stability and resilience. As the seventh-largest city in the United States and seventh in terms of growth, it has long attracted a diverse population. The city’s military roots provide a stable economic foundation, protecting it from market volatility. This stability has led to a real estate market that favors long-term investment and growth over house flipping.

San Antonio’s proximity to Austin (just a 90-minute drive away) also makes it an attractive option for investors from the Austin area who are looking for value without straying too far from home. The growing connection between the two cities suggests an interconnected future, making investing in San Antonio a smart move for those looking to capitalize on the broader growth of real estate investing in Central Texas.

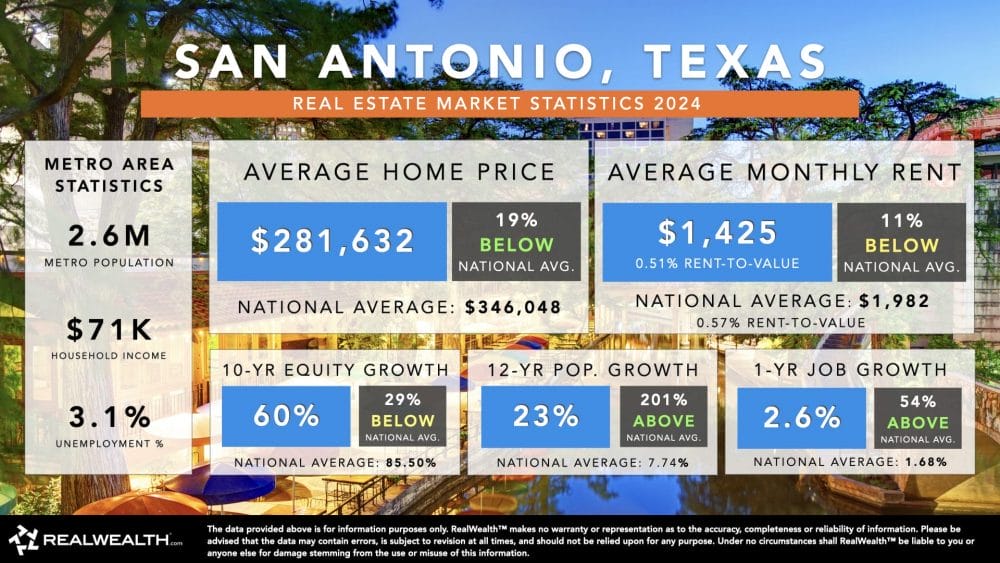

San Antonio Housing Market Statistics

- Median Household Income: $70,538

- Metro Population: 2.6 Million

- 12-Year Population Growth: 23.33%

- Median Home Price: $281,632

- Median Rent Per Month: $1,425 (0.51% rent-to-value ratio)

- 1-Year Equity Growth: 5.39%

- 10-Year Equity Growth (January 2014 – January 2024): 60.43%

- 1-Year Rent Growth: 3.88%

- 10-Year Rent Growth (January 2014 – January 2024): 40.89%

- Job Growth:+29,600 CES jobs created over the last year

- 1-Year Job Growth Rate: 4.52% (17.6% higher than the national average)

- Unemployment Rate: 3.1% (16% lower than the national average)

San Antonio Housing Market Quick Facts

- As of January 2024, the average single-family home price in San Antonio stood at $281,632. The city has witnessed a steady growth in home prices, with an appreciation rate of 5.39% per year, culminating in a 60.43% increase over the last decade.

- The average rent in San Antonio is currently $1,425, marking a significant increase of 40.9% over the past ten years. This indicates an average yearly growth rate of 3.9%.

- As of the fourth quarter of 2023, the rental vacancy rate in the San Antonio metro area was 11.9%, with 30.6% of households renting their homes.

- San Antonio is one of the fastest-growing metro areas in the country. Its population has increased 23.33% over the past 12 years, 201% faster than the national average. The current population is 2.65 million, with a growth rate of 2.12% annually.

- Between October 2022 and October 2023, the San Antonio metro area added 29,600 new jobs, showing a job growth rate of 2.59%, 55% higher than the US average.

- As of January 2024, the San Antonio metro area had a market hotness rank change of -3. A negative value indicates that the market has heated up compared to other metro areas.

- January 2024 data from Realtor.com shows the median listing price in San Antonio decreased by 3.3% year-over-year, while the active listing and new listing counts increased by 24.4% and 15.7%, respectively.

- The San Antonio metro area’s GDP was reported at $163 billion in 2022, with an 11.2% growth between 2021 and 2022.

Top 3 Reasons to Invest in the San Antonio Real Estate Market in 2024

1. Robust rental market

The rental market in San Antonio is strong with plenty of good rental property areas. Despite a recent slowdown, the year-over-year rent growth remains positive at 3.8%. Notably, between February 2021 and February 2022, San Antonio experienced a surge in rent growth by 24.2%. The city’s economic diversity attracts a continual influx of young professionals, while its tourist attractions, like the San Antonio Riverwalk and The Alamo, provide lucrative opportunities for short-term rental investments.

2. Strong population growth.

San Antonio is experiencing remarkable population growth, expanding by 23.3% from July 2010 to July 2022, significantly outpacing the national average. This growth has placed San Antonio as the third top city for numeric population increases from 2021 to 2022, with an addition of 18,889 people. The city’s cost of living, buzzing cultural scene, and outdoor activities appeal to people of different backgrounds.

3. Stable and diversified economy.

The economic landscape in San Antonio is both stable and diverse, anchored by significant sectors such as healthcare, military, finance, and tourism. The defense industry alone accounts for over 89,000 jobs, supported by multiple military bases, making it one of the largest employment sectors in the region. The city also stands out as a hub for cybersecurity, supported by a skilled workforce from local universities like UTSA.

Moreover, with an annual influx of approximately 32 million tourists, the city reaps substantial economic benefits from its vibrant tourism sector. This diversified economic base promotes job creation and attracts a steady stream of residents to San Antonio, presenting a promising prospect for real estate investors.

How To Purchase Investment Property in San Antonio

San Antonio’s rich cultural heritage and strong military presence offer a stable rental market, particularly for those looking near military bases or the downtown area, which attracts tourists year-round.

How to Purchase:

- Market research: Areas like Alamo Heights and the Pearl District have high rental demand.

- Legal considerations: Factor in Texas property taxes and consider the impact of state laws regarding landlord rights and tenant protections.

- Investment strategy: Research regulations related to short-term rentals and factor in potential military relocation impact on vacancy rates.

- Networking: Establish connections with local real estate professionals and investor groups to identify opportunities and understand the nuances of the market. Sign up for RealWealth to connect with the team we work with in the San Antonio metro area.

Best Neighborhoods to Invest in San Antonio

1. Eastside: Located a mere five minutes from downtown San Antonio. Its adjacency to major highways, including 90 and I-35, offers unparalleled connectivity. With a population of 26,500, Eastside is witnessing a noteworthy transformation, especially in areas like Denver Heights and Dignowity Hill, making it a magnet for young professionals and families.

Compared to the pricier neighborhoods of Alamo Heights or Olmos Park, Eastside offers a more accessible investment entry point. Moreover, its closeness to employment hubs and connections with regional centers amplifies its appeal for long-term investment prospects.

2. West San Antonio: If you’re looking for budget-friendly housing options, West San Antonio is the place to be. This area offers a diverse population and a vibrant cultural landscape, appealing to renters from various backgrounds. With its proximity to major employers like USAA and the expanding Lackland Air Force Base, West San Antonio is experiencing steady population growth. It is a prime location for first-time home buyers and investors seeking fixer-uppers or buy-and-hold rentals.

3. Bulverde: Located a comfortable 20-minute drive from downtown, Bulverde offers an enticing blend of accessibility and serenity, making it an attractive spot for families and young professionals. With a population of 6,900, the area enjoys steady growth, supported by excellent schools and the quiet allure of Texas Hill Country living.

Bulverde’s scenic landscapes and outdoor recreational venues provide a refreshing counterbalance to city life. The development of master-planned communities, such as Johnson Ranch, presents diverse housing opportunities, complete with community amenities and a strong neighborhood spirit. Investors looking for a blend of rural charm and proximity to urban conveniences will find Bulverde an ideal choice.

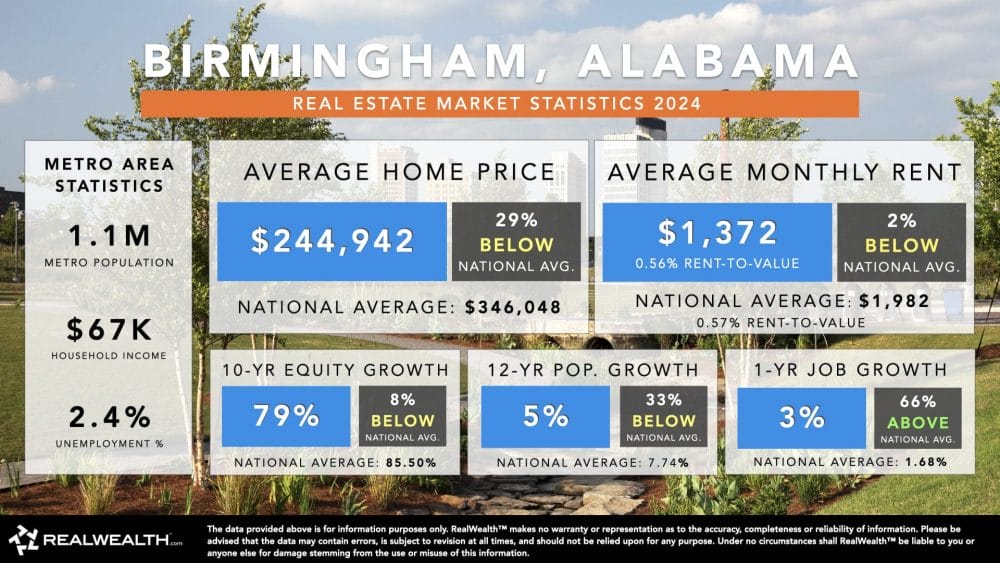

#5 – Indianapolis, Indiana

The Indianapolis real estate market is an excellent choice for investment properties, offering a winning combination of strong economic growth and affordability. This area has been getting bigger and better, with suburban counties like Boone and Hendricks growing by more than 20% between 2010 and 2020.

Indianapolis’ economic performance stands out among its Midwestern peers, with a GDP growth from 2019 to 2022 that surpassed cities like St. Louis, Cincinnati, Minneapolis-St. Paul, and even Chicago.

According to economist Joseph Politano, the Indianapolis metro area experienced an 8.4% increase in GDP from 2019 to 2022, amounting to a $12.1 billion growth. This success has solidified Indianapolis’ reputation as a thriving economic hub.

Despite the national housing market’s price surge, the Indianapolis metro area remains relatively affordable, with a median home price of $265,327 as of January 2024 – nearly 23% lower than the national average. This affordability and the region’s robust economic growth make Indianapolis an attractive option for investors seeking a balance of value and potential.

About the Indianapolis Housing Market

Indianapolis’ housing market offers positive cash flow opportunities, relative affordability, and a diversified local economy, making it an appealing destination for investors. Zillow ranks Indianapolis among the top ten hottest real estate markets for 2024, highlighting the city’s strong growth potential and appreciation.

The Indianapolis housing market has consistently risen in recent years. In January 2024, the median sales price for single-family homes in the city was $225,000, a 4.6% increase compared to the previous year. This steady appreciation, along with a 6.3% year-over-year increase in the number of homes sold, showcases the robust demand and desirability of the Indy metro area as one of the best places to buy rental property.

Indianapolis’ diversified economy sets it apart, providing a solid foundation for the local housing market. Indianapolis is a hub for healthcare, manufacturing, and education industries. Major employers include IU Health, the region’s largest employer with over 23,000 employees. The city is also home to leading logistics businesses, including hubs for FedEx Express and CSX and large pharmaceutical companies like Eli Lilly and Roche Diagnostics.

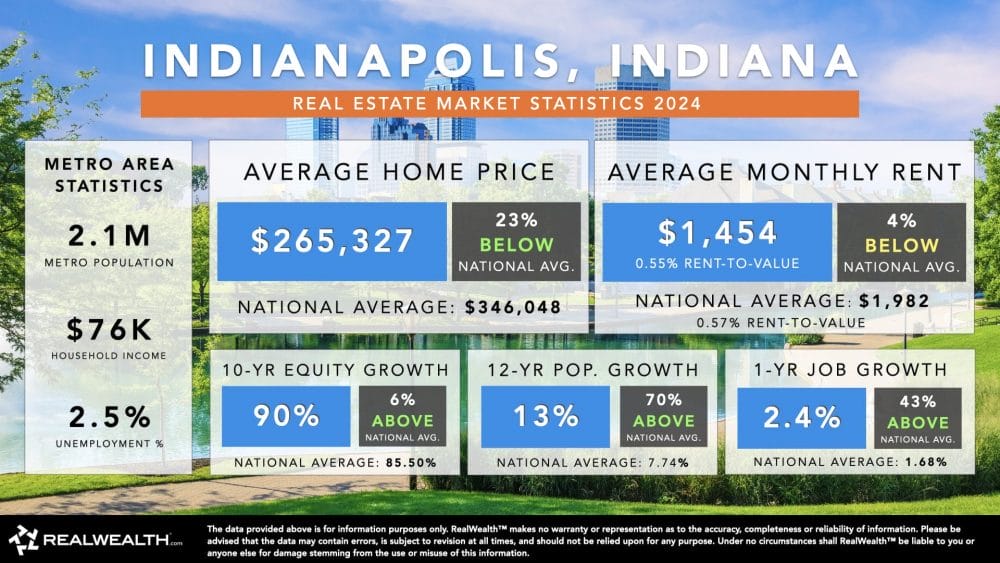

Indianapolis Housing Market Statistics

- Median Household Income: $75,824

- Metro Population: 2.1 Million

- 12-Year Population Growth: 13.16%

- Median Home Price: $265,327

- Median Rent Per Month: $1,454 (0.55% rent-to-value ratio)

- 1-Year Equity Growth: 7.43%

- 10-Year Equity Growth (January 2014 – January 2024): 90.54%

- 1-Year Rent Growth: 3.98%

10-Year Rent Growth (January 2014 – January 2024): 42.1% - Job Growth: +27,700 CES jobs created over the last year

- 1-Year Job Growth Rate: 2.4% (42.9% higher than the national average)

- Unemployment Rate: 2.5% (32% lower than the national average)

Indianapolis Housing Market Quick Facts

- As of January 2024, the median home price in the Indianapolis metro area is $265,327, 23% lower than the national average. Homes remain affordable despite a staggering 90.5% appreciation over the past decade and a 7.43% average annual appreciation rate.

- The average monthly median rent stands at $1,454, reflecting a 42% growth over the last decade at an annual rate of 4%.

- The population has increased by 13.16% in the last 12 years, growing 70% faster than the US average, with a current metro area population of 2.14 million as of the 2022 census.

- Between October 2022 and October 2023, the area created 27,700 jobs, marking a 2.4% annual job growth rate, 43% higher than the national average.

- The Indianapolis metro area has a rental vacancy rate of 8.1%, and 30.4% of households are renters.

- As of January 2024, the Indianapolis metro area had a market hotness rank change of 54 out of all metro areas nationally. This indicates that the market has cooled down compared to its previous ranking but remains a highly desirable location for cash flow investments.

- From January 2023 to January 2024, the median home listing price in Indianapolis rose by 7%, the active listing count increased by 6.6%, and the new listing count decreased by 3.9%.

- The Indianapolis-Carmel-Anderson metro area has a GDP of $184.3 billion, which grew by 10.2% between 2021 and 2022.

Top 3 Reasons to Invest in the Indianapolis Real Estate Market in 2024

1. Affordability

Indianapolis offers a more accessible real estate market compared to the national average. The average single-family home price in the Indianapolis metro area is $265,300, significantly lower than the national average of $346,000. This affordability attracts young homebuyers, with Generation Z accounting for over 20% of mortgage requests in the city.

2. Steady Population Growth

The Indianapolis metro area has consistently grown, with a population of around 2.1 million as of 2022. This growth is expected to continue, with the metro area projected to account for 62% of Indiana’s population growth by 2030. This steady influx of new residents creates a reliable demand for housing in the city and surrounding suburbs.

3. Appreciating Home Prices and Rents

The Indianapolis housing market has seen steady appreciation in home prices and rents over the past decade. Home prices in the city have appreciated by an average of 7.52% per year, outpacing the national average. Rent appreciation has also been strong, at around 4% per year. This consistent growth in property values and rental income makes Indianapolis attractive to real estate investors.

How To Purchase Investment Property in Indianapolis

Indianapolis offers attractive opportunities for rental property investors due to its affordable cost of living and a strong job market in healthcare, education, and tech.

How to Purchase:

- Identify the best areas: Look for properties in up-and-coming neighborhoods like Fountain Square or established areas like Broad Ripple for a mix of residential and commercial investments.

- Legal framework: Indiana’s laws are generally considered favorable to landlords. However, be mindful of local ordinances in Marion County or specific Indianapolis city regulations.

- Research: Research revitalization efforts in specific neighborhoods and be mindful of potential property tax changes.

- Investment strategy: Given relatively lower property prices, investors might consider acquiring multiple properties within the city to diversify their portfolios.

- Get assistance: Sign up to RealWealth to connect with the team we work with in the Indianapolis metro area.

Best Neighborhoods to Invest in Indianapolis

1. New Castle: Located just 20 miles east of downtown Indianapolis, New Castle offers affordable investment opportunities. With some properties selling for less than $100,000, this market provides accessible entry points for real estate investors. The area is home to major employers like Duke Energy, Grede Casting Company, and American Keeper Corp., which are creating a stable economic foundation.

2. Muncie: Muncie, located 50 miles northeast of Indianapolis, was recently ranked one of the best markets for first-time homebuyers. Affordable housing, growth potential, and favorable demographics make Muncie attractive. Additionally, the presence of Ball State University provides a steady pool of potential tenants for rental properties.

3. Rockport: While not directly part of the Indianapolis metro area, Rockport, located approximately 120 miles southwest of Indianapolis, still benefits from the broader trends impacting Indianapolis’s real estate market. Rockport’s rich history as a port town and its diverse local employers, including Waters of Rockport and Precision Strip, make it a unique investment opportunity for those seeking to diversify their portfolio beyond the immediate Indianapolis region.

#6 – Cleveland, Ohio

The Cleveland metropolitan area offers a compelling real estate investment opportunity, balancing affordability and promising growth potential. Although Cleveland may not experience rapid population surges like other major markets, it maintains a steady population of around 2.06 million, providing a stable foundation for long-term investment.

Cleveland’s diverse economic landscape, anchored by thriving healthcare, manufacturing, and bioscience sectors, attracts a steady influx of young professionals and families. Approximately 35% of households in the metro area choose to rent rather than own, creating a consistent tenant pool.

Cleveland’s real estate market provides an attractive alternative with some of the best places to buy investment property for investors seeking a market that offers more measured, sustainable growth instead of the boom-and-bust cycles of some overheated markets.

About the Cleveland Housing Market

The Cleveland-Elyria metropolitan area, comprising six counties, has a rich history dating back to its industrial heyday. Once a manufacturing powerhouse, the region has evolved, diversifying its economy into thriving healthcare, bioscience, and technology sectors. This economic transformation, combined with the city’s cultural attractions and natural amenities, such as Lake Erie and the Rock and Roll Hall of Fame, has created a dynamic investment climate, particularly for rental real estate.

At the heart of the city’s appeal is its affordability. Cleveland’s median home sale price currently stands at a modest $105,000. In contrast, the average single-family home price in the broader Cleveland-Elyria metropolitan area is $211,500 – significantly lower than the national average. This affordability and a 13.1% year-over-year increase in median listing prices highlight the upside potential for investors seeking to capitalize on Cleveland’s rising market.

According to a recent Zillow report, Cleveland is expected to be the eigth hottest housing market in 2024, driven by a combination of forecast home value growth, robust housing market velocity, and promising labor market and construction activity projections.

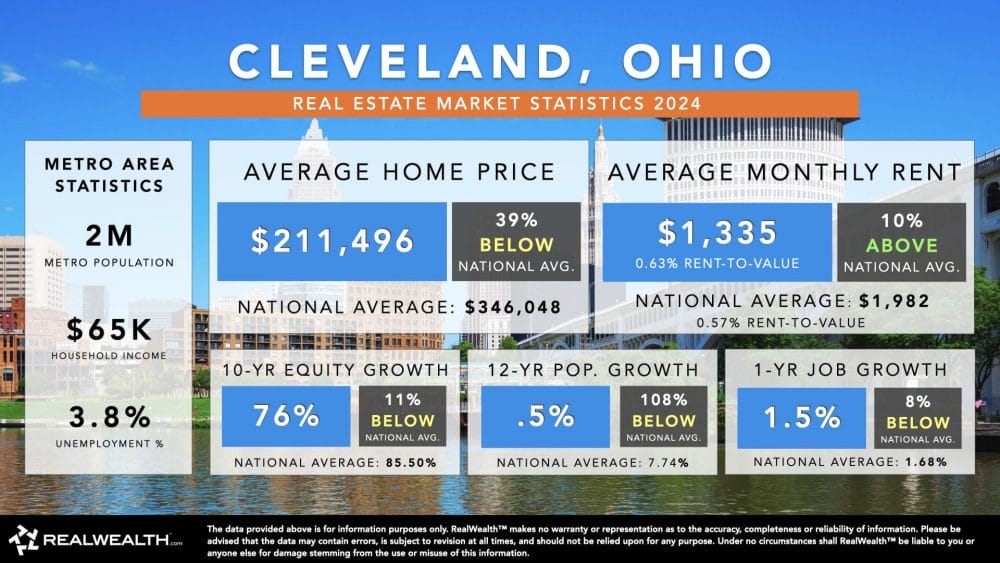

Cleveland Housing Market Statistics

- Median Household Income: $65,198

- Metro Population: 2 Million

- 12-Year Population Growth: -0.59%

- Median Home Price: $211,496

- Median Rent Per Month: $1,335 (0.63% rent-to-value ratio)

- 1-Year Equity Growth: 6.49%

- 10-Year Equity Growth (January 2014 – January 2024): 76%

- 1-Year Rent Growth: 3.77%

- 10-Year Rent Growth (January 2014 – January 2024): 39.53%

- Job Growth: +16,200 CES jobs created over the last year

- 1-Year Job Growth Rate: 1.54% (8.13% lower than the national average)

- Unemployment Rate: 3.8% (5.4% higher than the national average)

Cleveland Housing Market Quick Facts

- Over the past decade, home prices in the Cleveland metro have grown by a robust 76%, equating to an annual appreciation rate of 6.49%. As of January 2024, the average home value is a relatively affordable $211,500.

- The average rent in Cleveland is $1,335, and it has grown by 39.5% over the past 10 years at an annual rate of 3.77%.

- As of November 2023, job growth in the Cleveland metro area is stable at 1.54% per year, slightly below the national average of 1.68%.

- The rental vacancy rate is 9.7%, with 36.8% of the Cleveland metro area households opting to rent.

- Over the last 12 years, the Cleveland metro area’s population has slightly declined by 0.59%, with a current estimate of 2.1 million residents. However, Greater Downtown Cleveland has seen a significant increase in the number of households by 21.8% between 2010 and 2020, indicating a faster pace of growth compared to the broader area.

- The GDP of the Cleveland metro area stands at about $163 billion, marking a growth of 9.1% from 2021 to 2022.

- In January 2024, home prices in Cleveland increased by 13.1% year over year, with the active listing and new listing count decreasing by 4.4% and 4.9%, respectively.

- With a rank change of -3 in January 2024 for market hotness, Cleveland’s real estate market is still hot compared to other US markets.

Top 3 Reasons to Invest in the Cleveland Real Estate Market in 2024

1. Affordable real estate market

In 2024, the projected typical home value in Cleveland is $215,597, significantly lower than the nationwide average of $347,415. Neighborhoods like North Collinwood and South Broadway offer attractive investment opportunities with median sale prices under $100,000. Plus, Cleveland’s recognition by Zillow as one of the top American housing markets to watch in 2024 suggests that while homes are affordable now, their values will likely increase.

2. High rental yield potential

Cuyahoga County, which includes Cleveland, boasts one of the highest potential annual gross rental yields among U.S. counties with a population of at least 1 million, reaching an impressive 9.9% in the first quarter of 2021. With 58% of all households in Cleveland occupied by renters, the city presents a robust rental market and the potential for investors to capitalize on high rental yields. While rental growth peaked in the second quarter of 2022, it continues to increase at 3.77% year-over-year, further solidifying the rental income opportunities.

3. Steady home price and rent appreciation

Cleveland’s real estate isn’t just affordable; it also comes with the promise of growing value. Over the past 10 years, the Cleveland metro area has seen an average annual appreciation rate of 6.49% for homes, totaling a remarkable 76% appreciation. Additionally, the average rent in the Cleveland metro area has increased by 39.5% over the last 10 years, with a 6.8% year-over-year increase in Cleveland between February 2023 and February 2024, showcasing steady and reliable appreciation potential.

How To Purchase Investment Property in Cleveland

Cleveland offers a robust rental market with good rental property areas and relatively low property prices, making it an attractive area for investment. The city has been experiencing urban revitalization, which has contributed to property value appreciation.

How to Purchase:

- Research: Understand neighborhood dynamics, focusing on areas with revitalization projects.

- Property taxes: Taxes vary significantly between neighborhoods; do your due diligence.

- Financing: Local banks and credit unions offer competitive mortgage rates for investment properties.

- Legal considerations: Be aware of tenant laws in Ohio, which tend to be more favorable to landlords.

- Networking: Connect with local real estate agents and investors with experience in the Cleveland market. Sign up to RealWealth to connect with the team we work with in the Cleveland metro area.

Best Neighborhoods to Invest in Cleveland

1. Euclid: Euclid, a vibrant Cuyahoga County suburb, is undergoing a remarkable transformation. The city’s ambitious Waterfront Development Project redefines the urban landscape, creating a dynamic mixed-use district that seamlessly blends residential, commercial, and recreational spaces along the lakefront.

This revitalization effort is set to attract new residents and visitors, driving up property values. Additionally, Euclid’s thriving Industrial Corridor, home to major companies like Amazon and Lincoln Electric, contributes to the local economic growth, making it an enticing investment destination.

2. Wickliffe: Nestled in Lake County, the suburb of Wickliffe offers a mature population with a higher median age than the Cleveland metro average, making it an attractive option for investors seeking to cater to retirees or empty nesters. While Wickliffe’s economy leans more towards manufacturing and healthcare, it provides a stable foundation for rental income, with major employers like Precision Castparts, Lubrizol, and PMC Colinet anchoring the local job market.

3. Downtown Cleveland: Downtown Cleveland has undergone a remarkable transformation, emerging as a hub of activity and investment. With over $1 billion in projects currently under construction and a residential population that has doubled in the last 10 years, the area offers a unique opportunity for real estate investors.

The ongoing revitalization of the lakefront, the expansion of the Rock & Roll Hall of Fame, and the influx of major global brands and startups like the London Stock Exchange Group, BrightEdge, OnShift, and Alexander Mann Solutions have all contributed to Downtown Cleveland’s growing appeal. With a staggering 85.29% of the housing units occupied by renters, the area presents a compelling case for investors seeking high-yield rental properties.

#7 – Charlotte, North Carolina

The Charlotte metropolitan area, also known as Metrolina, is an attractive destination for real estate investors and homebuyers. Ranked seventh on Zillow’s list of the hottest housing markets for 2024, Charlotte’s popularity can be attributed to its diverse and rapidly growing economy, which includes strong finance, healthcare, and technology sectors. This economic growth is expected to draw new residents, leading to a robust and expanding housing demand.

The Charlotte real estate market offers a unique investment opportunity. Its projected job growth rate of 45.2% over the next decade surpasses the national average of 33.5%.

About the Charlotte Housing Market

The Charlotte metro area, known for its blend of urban development and appealing lifestyle features, is a popular choice for real estate investors nationwide. Its broad appeal attracts a diverse demographic thanks to a mild four-season climate and proximity to both mountains and beaches. This results in consistent demand in both the rental and resale markets.

With an average home value of $367,280 and a significant increase in suburban rent growth in Q1 2023—36% year-over-year (YOY) in the suburbs compared to 25% in Charlotte proper—the area shows promising growth and opportunity. The University of North Carolina at Charlotte also adds a sizable student and young professional population, ensuring a steady demand for rental housing.

Historically, Charlotte’s economy, rooted in finance, has provided a stable environment for the housing market. As the city expanded its economic base to include healthcare, technology, and education, the housing market followed suit, with increased demand and subsequent value appreciation. The turn of the millennium saw Charlotte flourishing as a hub for new residents, drawn by job opportunities and its renowned quality of life. Below are additional reasons we choose Charlotte as one of the best places to buy rental property.

Charlotte Housing Market Statistics

- Median Household Income: $77,154

- Metro Population: 2.8 Million

- 12-Year Population Growth: 22.49%

- Median Home Price: $331,741

- Median Rent Per Month: $1,778 (0.44% rent-to-value ratio)

- 1-Year Equity Growth: 9.17%

- 10-Year Equity Growth (January 2014 – January 2024): 120.2%

- 1-Year Rent Growth: 4.86%

- 10-Year Rent Growth (January 2014 – January 2024): 53.2%

- Job Growth: +103,800 CES jobs created over the last year

- 1-Year Job Growth Rate: 2.14% (27.5% higher than the national average)

- Unemployment Rate: 3.2% (13.5% lower than the national average)

Charlotte Housing Market Quick Facts

- The average sales price of single-family homes in the Charlotte Metropolitan Statistical Area (MSA) is $367,281. Over the past decade, home prices in Charlotte have surged by 120%, outpacing the U.S. average by 41%. Annually, home prices in Charlotte have seen an average growth rate of 9.17%.

- The average rent in the Charlotte metro area is currently $1,778. Over the last ten years, rents in Charlotte have increased by an average of 4.86% per year, with a total growth of 53%, 28% faster than the national average.

- Between November 2022 and November 2023, the Charlotte area added 103,800 new jobs, marking a job growth rate of 2.14%, 27.5% faster than the national average for the same period.

- Charlotte’s metro area population has increased by 22.49% since 2010, nearly 200% faster than the U.S. average, reaching 2.8 million residents.

- The rental vacancy rate in the Charlotte metro area is 7.5%, with 38.5% of households renting homes.

- Charlotte’s GDP is approximately $229 billion, having grown by 9.2% between 2021 and 2022.

- As of January 2024, Charlotte home prices rose by 1.3% year over year. While the active listing count decreased by 5.9% year-over-year, the new listing count increased by 7.4%.

- As of January 2024, the Charlotte metro area had a market hotness rank change of -15 compared to all other metro areas nationally, indicating that the market has heated up and moved up in ranking.

Top 3 Reasons to Invest in the Charlotte Real Estate Market in 2024

1. Rapid population growth

The Charlotte metro area consistently ranks among the fastest-growing in the U.S., adding over 200,000 new residents between 2016 and 2021, a remarkable 8.1% increase. This growth is fueled by a thriving job market, affordable living, and high quality of life.

2. Soaring home prices and rents

Charlotte’s housing market has seen exceptional appreciation, with home prices growing by 120% over the past decade, at an average annual rate of 9.17%, outpacing the national average. Rents have also surged, increasing by 53.2% in the last 10 years, 28% faster than the U.S. average.

3. Diverse and robust economy

Charlotte’s economy thrives on diverse sectors, including financial services, healthcare, advanced manufacturing, and technology. Major corporate investments, such as Microsoft’s $1 billion project and Albemarle Corporation’s $180 million technology park, further strengthen the region’s economic resilience and future growth potential, driving housing demand.

How To Purchase Investment Property in Charlotte

Charlotte is one of the fastest-growing metro areas in the U.S., with a strong financial services sector and a growing tech scene. Although property values have been increasing, they remain relatively affordable compared to other growth cities.

How to Purchase:

- Market analysis: Focus on upcoming neighborhoods and suburbs for the best investment returns.

- Financing options: Look for investment-specific mortgage products offered by North Carolina banks.

- Local regulations: Familiarize yourself with North Carolina’s property management requirements and rental laws.

- Professional help: Consider hiring a property manager, especially if you are investing from out-of-state. Sign up to RealWealth to connect with the team we work with in the Charlotte metro area.

Best Neighborhoods to Invest in Charlotte

1. Shelby: Located 45 minutes west of Charlotte, Shelby offers a more affordable alternative for those seeking proximity to the Queen City. With a population of nearly 22,000, Shelby boasts a lower cost of living, particularly in housing, while providing easy access to Charlotte’s thriving job market and amenities. Major employers like Curtiss-Wright Controls and HCLTech have established a presence in Shelby, driving economic growth and housing demand.

2. Salisbury: Between Charlotte and the Triad region, Salisbury is well-connected to transportation networks, including Interstate 85 and the Norfolk-Southern Main Line. This central location within the Charlotte metro area provides access to a large labor pool and positions Salisbury for potential growth and investment. Recent investments, such as DHL Supply Chain’s $40 million logistics center, highlight the area’s appeal for logistics and distribution companies.

3. Kings Mountain: Just 35 miles west of Charlotte, Kings Mountain is experiencing significant investment due to its proximity to the Queen City and its growth potential. The city is home to a recently reopened lithium mine, which is expected to support the manufacturing of 1.2 million electric vehicles annually, making it a key player in the nation’s battery supply chain. The upcoming $750 million “Dixon Ridge” mixed-use development further highlights Kings Mountain’s attractiveness as an investment destination in the Charlotte metro area.

#8 - Baltimore, Maryland

The Baltimore metropolitan area offers an enticing investment prospect for those looking to capitalize on a transitioning real estate market. As the region adjusts to post-pandemic life, experts anticipate a sustained trend of higher inventory levels, though still below pre-pandemic figures, and an increase in home sales at elevated prices.

According to the latest report from the Baltimore Metropolitan Council, specific neighborhoods in South Baltimore, Crownsville, and Maryland City have been pinpointed as “hot spots” for residential development. This indicates the possibility for growth and appreciation in these locations as some of the best places to buy rental property.

The Baltimore real estate market is bolstered by a consistent job market, with an annual growth rate of around 1.9%. The region’s varied industries, such as healthcare, education, and biotechnology, contribute to stability and draw in new residents.

While some neighborhoods may provide fixer-upper opportunities, investors should be cautious of the varying crime rates across the Baltimore metro area. By thoughtfully assessing each location’s unique qualities and dynamics, astute investors can discover promising investment opportunities that align with their risk tolerance and objectives.

About the Baltimore Housing Market

Baltimore’s housing market has seen its fair share of ups and downs, mirroring its historical development. Once known as a major shipping and manufacturing hub in the 20th century, the city shifted towards service industries, with healthcare becoming a dominant force in its economy. This shift brought stability and growth potential to Baltimore’s residential real estate market.

The city’s beautiful architecture, with a mix of historic row houses and modern buildings, tells the story of Baltimore’s resilience and adaptability. These landmark homes offer exciting renovation possibilities for those who love unique properties.

Baltimore’s extensive public transportation network adds another layer of convenience and connectivity. This accessibility makes living in Baltimore appealing to those who prefer to commute via public transit.

The cost of living is a bonus. With approximately 30% cheaper housing than in neighboring Washington, D.C., Baltimore is attractive for professionals seeking to save money while staying close to the capital.

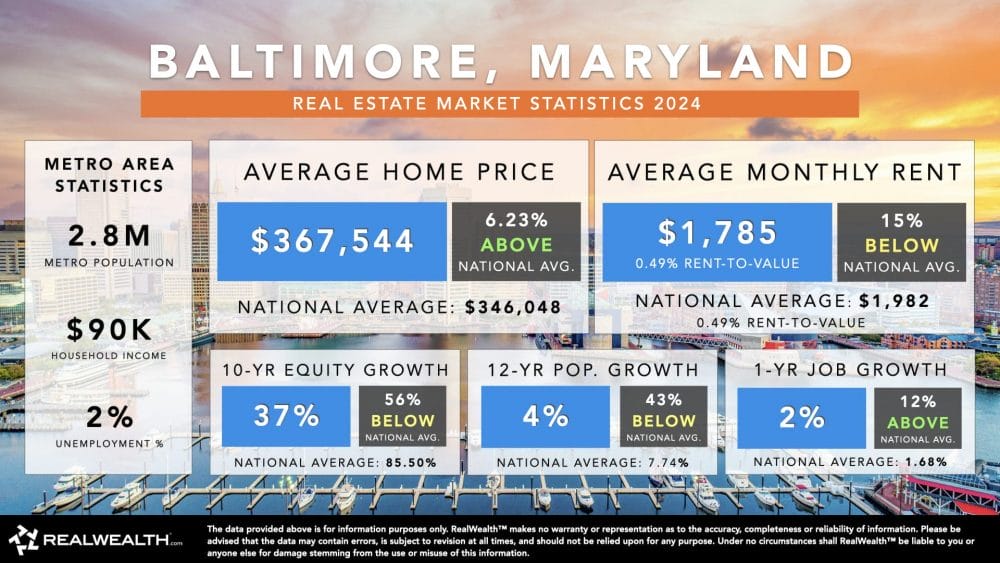

Baltimore Housing Market Statistics

- Median Household Income: $90,505

- Metro Population: 2.8 Million

- 12-Year Population Growth: 4.42%

- Median Home Price: $367,544

- Median Rent Per Month: $1,785 (0.49% rent-to-value ratio)

- 1-Year Equity Growth: 3.57%

- 10-Year Equity Growth (January 2014- January 2024): 37%

- 1-Year Rent Growth: 1.7%

- 10-Year Rent Growth (January 2014 – January 2024): 16.6%

- Job Growth: +26,300 CES jobs created over the last year

- 1-Year Job Growth Rate: 1.89% (12.3% higher than the national average)

- Unemployment Rate: 2% (46% lower than the national average)

Baltimore Housing Market Quick Facts

- The median home price in the Baltimore metro area is $367,544. Home equity growth has been lower than the national average. Home prices rose by 37.1% over the last 10 years, with an annual growth rate of 3.57%.

- The median rent is $1,785 per month. Rents have also appreciated very slowly compared to the U.S. average. The average rent price increased by 16.6% at 1.72% per year over the last 10 years.

- Baltimore’s population has grown slower than the national average, with a current population of 2.83 million. The population of Baltimore grew by 4.42% in the last 12 years, at an average annual rate of 0.43%.

- Baltimore’s employment growth is slightly higher than the national average. Between November 2022 and November 2023, the metro area created 26,300 new jobs, representing a growth rate of 1.89%, 12.4% higher than the national average.

- In January 2024, Baltimore home prices increased by 2.3% yearly, while active listing and new listing count decreased by 4.6% and 3%, respectively.

- As of Jan 2024, Baltimore’s market hotness has a rank change of 2 compared to other U.S. metro areas. This indicates a slight cooling trend in the market, as a positive value suggests a downward movement in rank.

- Baltimore’s GDP rose 7.5% from 2021 to 2022, amounting to $241 billion.

- 26.3% of households in the Baltimore metro area are renters. The rental vacancy rate in the region decreased significantly to 6.2% in Q4 2023 from 12.8% in Q1 2023.

Top 3 Reasons to Invest in the Baltimore Real Estate Market in 2023

1. Rental yield potential

Baltimore’s job market is attracting many young professionals, and because it’s more affordable than nearby Washington, D.C. (homes cost about 30% less!), many are looking to rent there. The city’s great public transportation system, including buses, light rail, and subway, also makes it an attractive place to live.

2. Student population boom

Baltimore hosts several major universities and colleges, including Johns Hopkins, UMBC, and Towson University. With a combined student population of over 98,000 for the 2022-2023 academic year, the city’s large student base contributes to a high demand for rental properties.

3. Diversified and growing economy

Baltimore’s economy is highly diversified, with thriving healthcare, education, government, defense, technology, cybersecurity, finance, and logistics industries. Additionally, Baltimore’s status as the 8th most educated metro region in the U.S. further enhances its appeal for real estate investors.

How To Purchase Investment Property in Baltimore

Baltimore presents a unique market with historic properties and diverse neighborhoods. The city has numerous redevelopment projects, which present investment opportunities.

How to Purchase:

- Property inspection: Given the age of many Baltimore properties, thorough inspections are crucial.

- Tax incentives: Investigate Maryland’s tax incentives for rehabilitation and rental properties.

- Community development: Identify neighborhoods with strong community organizations and development plans.

- Legal and financial advice: Consult a real estate attorney or agent for Maryland-specific regulations.

- Partner with a local expert: Sign up for RealWealth to connect with the team we work with in the Baltimore metro area.

Best Neighborhoods to Invest in Baltimore

1. Dundalk: Dundalk’s prime location near major highways like I-95 and I-695 provides easy access to Baltimore City, Anne Arundel County, and other parts of Baltimore County. With a median property sale price of $222,500, up about 10% year-over-year, Dundalk offers a more affordable investment opportunity than other areas in the Baltimore region.

The area also boasts a diverse job market, including an Amazon fulfillment center, the Maryland Transport Authority, and the nearby Johns Hopkins Bayview Medical Center, making it an appealing place to live and work.

2. Towson: North of Baltimore City, Towson provides a unique blend of urban amenities and suburban tranquility. Its proximity to the city attracts residents seeking the benefits of city living at potentially lower costs. Hosting Towson University, the area benefits from the vibrancy and economic stimulation associated with a significant academic institution. With its mix of restaurants, shops, entertainment, and high-quality schools, Towson appeals to those seeking a rich, convenient lifestyle, potentially allowing investors to command higher rents.

3. Parkville: Parkville, a town in the Baltimore metro area, offers a quiet, residential atmosphere with transportation links and easy access to major cities like Baltimore and Washington, D.C. Just seven miles from Baltimore and 42 miles from Washington, D.C., Parkville provides a convenient location for commuters and travelers, with proximity to BWI Airport. The median home price in Parkville is $300,000, with a 10.1% increase in the past year, making it a promising investment opportunity.

#9 – Cincinnati, Ohio

Cincinnati is witnessing strong housing demand and increasing median home prices, catching the attention of savvy investors seeking opportunities in this Midwestern city.

The city’s well-established transportation infrastructure, including a major international airport and a comprehensive public transit system, improves Cincinnati’s livability and contributes to the sustained demand for real estate. Moreover, the local economy has shown resilience, supporting the steady appreciation of home values, averaging a 7.3% yearly increase over the past decade, earning it a spot as one of the best places to buy rental property.

About the Cincinnati Housing Market

The Cincinnati real estate market has weathered economic cycles with remarkable stability throughout history. Unlike coastal markets, which have experienced volatile highs and lows, Cincinnati maintains a steadier course. This enduring appeal is due to a combination of factors that have historically strengthened the city’s economy.

Cincinnati’s growth as a manufacturing hub, its strategic location by the Ohio River, and the presence of major companies have established the city as an economic Midwest powerhouse. Over the years, this economic foundation has provided a buffer against downturns that have affected other regions more severely.

The healthcare and education sectors have also been crucial to Cincinnati’s economy, with world-class institutions like Cincinnati Children’s Hospital Medical Center and the University of Cincinnati stabilizing and attracting a steady influx of professionals seeking long-term residences.

With a median home price around $250,000, properties are selling quickly in Cincinnati. They often receive multiple offers and sell close to or slightly below the asking price. Furthermore, the average time for a home to go pending is around 17 days, highlighting the market’s frenetic pace.

Additionally, the area is experiencing a demographic surge, with a significant net inflow of individuals from other metropolitan areas, including Dayton, Los Angeles, and Chicago. For investors looking for a stable and profitable real estate market, the Cincinnati metro area offers an enticing opportunity.

Cincinnati Housing Market Statistics

- Median Household Income: $75,062

- Metro Population: 2.2 Million

- 12-Year Population Growth: 5.81%

- Median Home Price: $267,184

- Median Rent Per Month: $1,510 (0.57% rent-to-value ratio)

- 1-Year Equity Growth: 7.27%

- 10-Year Equity Growth (January 2014 – January 2024): 88%

- 1-Year Rent Growth: 4.79%

- 10-Year Rent Growth (January 2014 – January 2024): 52.3%

- Job Growth: +21,700 CES jobs created over the last year

- 1-Year Job Growth Rate: 1.89% (12.7% higher than the national average)

- Unemployment Rate: 3.1% (16% lower than the national average)

Cincinnati Housing Market Quick Facts

- Cincinnati has been recognized as the second-hottest housing market in the U.S. by Zillow.

- The average price for a single-family home in the Cincinnati metro area in January 2024 was $267,184, making it about 23% more affordable than the national average. Over the past ten years, home prices in Cincinnati have risen by 88%, at a steady annual rate of 7.27%.

- The average monthly rent in Cincinnati is $1,510, 24% lower than the national average. Cincinnati’s rent prices have appreciated 52.3% in the past decade, growing at an average of 4.8% each year.

- Cincinnati’s population has expanded by 5.81% in the last 12 years, an annual growth of 0.57%. Although this growth is slower (25% less) than the national average, it represents a steady influx of new residents.

- While Cincinnati’s population growth has been slightly slower than the national average, the metro area has maintained a stable economy. Between November 2022 and November 2023, the metro area added 21,700 jobs, a job growth rate of 1.9%—slightly higher than the national average.

- Nearly one-third of Cincinnati metro households, 30.7%, rent their homes, and the rental vacancy rate drastically improved from 10.9% in Q3 2023 to 6.2% in Q4 2023.

- Cincinnati has an impressive GDP of $186 billion, which grew by 8.4% between 2021 and 2022.

- As per Realtor’s estimates, in January 2024, home prices in Cincinnati saw a modest yearly increase of 0.7%. Meanwhile, the active listing count and new listing count experienced a significant rise of 19.5% and 10%, respectively.